The Sukuk market is likely to receive a much-needed boost as Iran, home to the world’s biggest Islamic banking sector, with assets estimated at $482 billion, and the fourth largest crude oil reserves returns to the world capital markets. »

Saudi Arabia makes Bond Sales to Fund Deficit, Saudi Arabia makes Bond Sales to Fund Deficit and Islamic Bank Finances Surge 107% in Oman. »

Sovereign Update: Net foreign assets contracted for four quarters in a row to USD664.4bn in Jun-15, falling by USD72.6bn since their peak in Aug-14; Expectations of higher government debt of USD5.3bn to reduce their elevated budget deficit amid falling oil revenues, continuing government expenditure and war in Yemen. »

SOVEREIGN UPDATES: Fuel subsidies on gasoline and diesel will be abolished by 24% and 29% respectively effective 3rd August. We believe the rationalisation of subsidies could help to bolster government finance from plunge in global oil prices (as the government revenue has fallen about 50% in 2014) and would benefit the economy in the long run. »

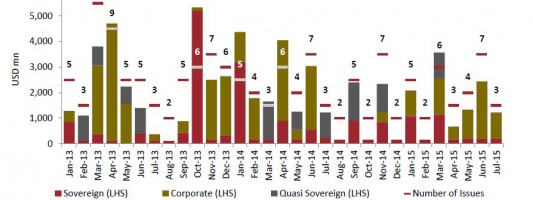

GCC Market Update by Rasameel. Over the last month banks in the UAE have preferred conventional bonds issuance whilst Saudi banks have taken the Sukuk route. »

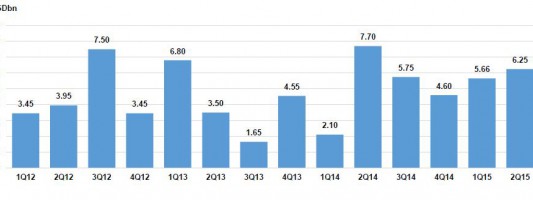

Short Term Sukuk is Recycled money and does not equate to a market Correction. Bank Negara has been in previous years been a prolific issuer of short-term sukuk, which by its very nature is short dated paper with maturity dates of less than one year. It is misleading to use such sukuk to accurately represent market demand as such short term sukuk are re-issued multiple times through-out the year. »

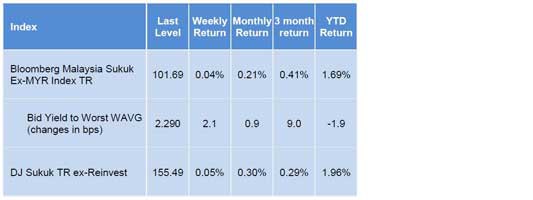

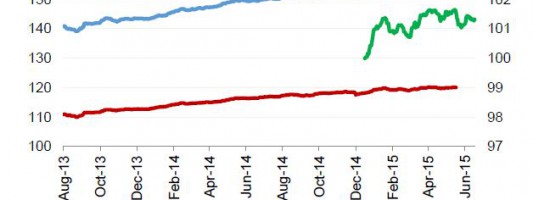

The Bloomberg Malaysia Sukuk Ex-MYR Total Return Index (BMSXMTR) inched lower by 0.05% during the week to 101.3 (vs. -0.02% to 101.38 in week prior). The Dow Jones Sukuk Total Return Index (DJSUKTXR) also dropped by 0.18% W-o-W to 154.7 (vs. +0.11% to 155.0), lowering YTD gains by 18bps to 1.46% (vs. +12bps to 1.65%). »

An IMF working paper examined key features of modern public debt management legal frameworks and took a specific look at Sukuk legal frameworks in the UK, Turkey and Luxembourg. »

Demand for funds by Malaysian infrastructure companies is driving up sales of Islamic bonds. Ringgit-denominated sukuk issuances are set to hit their highest quarterly levels in more than a year. Bloomberg TV Malaysia's Sophie Kamaruddin and Han Tan discuss the factors driving the recent rise. »

Sukuk structures in accordance with the principles of Shari’ah are the same as the principles which apply to other products in Islamic law and finance. Real world case studies and guides produced by Latham and Watkins, and Linklaters. »