Commentary by RHB Global Sukuk Markets Research, Kuala Lumpur, Malaysia

Sukuk Returns stumbled

Article Overview

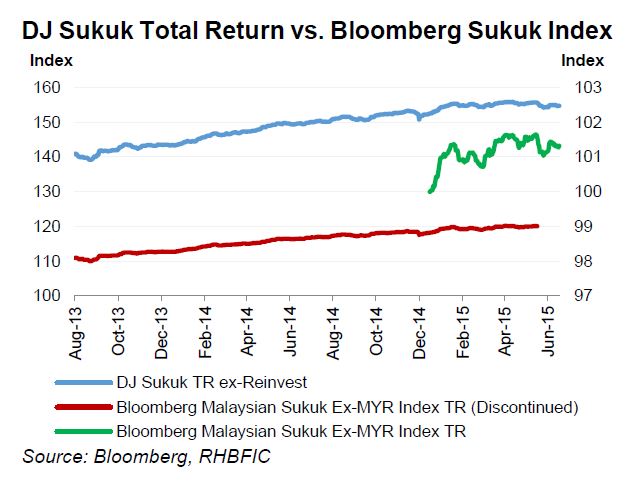

The Bloomberg Malaysia Sukuk Ex-MYR Total Return Index (BMSXMTR) inched lower by 0.05% during the week to 101.3 (vs. -0.02% to 101.38 in week prior). The Dow Jones Sukuk Total Return Index (DJSUKTXR) also dropped by 0.18% W-o-W to 154.7 (vs. +0.11% to 155.0), lowering YTD gains by 18bps to 1.46% (vs. +12bps to 1.65%). Meanwhile, the weighted average yield of BMSXMTR rose 3.8bps W-o-W to 2.315% (vs. -0.5bps to 2.277%); with worst performers led by KFINKK 6/19, SECO 4/24, ISDB 6/17, QATAR 1/23, and ISDB 3/19 shedding USD33m in value (week prior: 18.61m).

Sukuk started the week on a bad note as expected, but picked up mid-week after: 1) Greece counteroffered the bailout proposal it had previously rejected; 2) discussions on Iran’s nuclear agreement (a prelude to sanctions uplift) passed its 30-June deadline; and 3) Fitch unexpectedly revised Malaysia’s sovereign rating to ‘A-/Stable’ from ‘A-/Negative’. The US also surprised as non-farm payrolls (NFP) was revised down to 254k (from 280k) for May and fell short of expectations at 223k (consensus: 233k) for June, leading to a rally in UST yields, tightening 1-7bps before closing for 4-July holidays.

Risk aversion rises

Geopolitical tensions and oil price jitters (from the Iran deal and higher rigs-count in US) led CDS spreads to rise 1-5bps in the Gulf, except for Bahrain (-8.6bps to 269) where Sunnis and Shiites held joint prayers on Friday. Elsewhere, Indonesia’s CDS widened 1.6bps to 169 on higher inflation and weaker consumer confidence; while Malaysia’s narrowed 2.8bps to 129 after Fitch revised the sovereign’s Rating/Outlook to ‘A-/Stable’ (from ‘A-/Negative’) citing improving fiscal finances.

Market volatility to be event-driven

Greece decided to vote no (61%) for the austerity measures on Sunday, which could prolong the period of uncertainty in Europe. Earlier, the survey hinted on a mixed views (refer to Chart of the Week), Iran may see a drafted nuclear agreement by the extended 7-July deadline. The US will publish services sector growth and trade data before releasing FOMC minutes on Thursday night. In China, authorities suspended IPOs, announced a market stabilisation fund, and pleaded investors to refrain from panic to stem a stock market sell-down that has wiped out 29% (or USD2.8trn) from the Shanghai Composite Index (SHCOMP) since its 12-June peak, completely ignoring PBOC’s 25bps rate cut to 4.85% last weekend, and easing of margin-trading rules and trading fees Wednesday.

Sovereign Comments

Fitch reaffirmed Malaysia’s LTFC sovereign rating at ‘A-‘ and revised the Outlook to ‘Stable’ from ‘Negative’, mainly due to improving fiscal finances; i.e. budget deficit narrowed to 3.8% of GDP and government debt/GDP declined to 53.9% in 2014 (2013: 4.6% and 54.7% respectively). Similarly, Fitch reaffirmed PETMK’s ratings at ‘A’ and revised the Outlook to ‘Stable’ (from ‘Negative’).

Abu Dhabi Islamic Bank

Bank gets increased authorisation for issuing T1 sukuk to USD3.0bn (from USD2.0bn).