The Oasis Crescent Global Equity Fund (OCGEF) is a Shari’ah compliant equity fund that seeks to provide investors with an ethical investment product. The Fund conforms to moral and cultural beliefs.

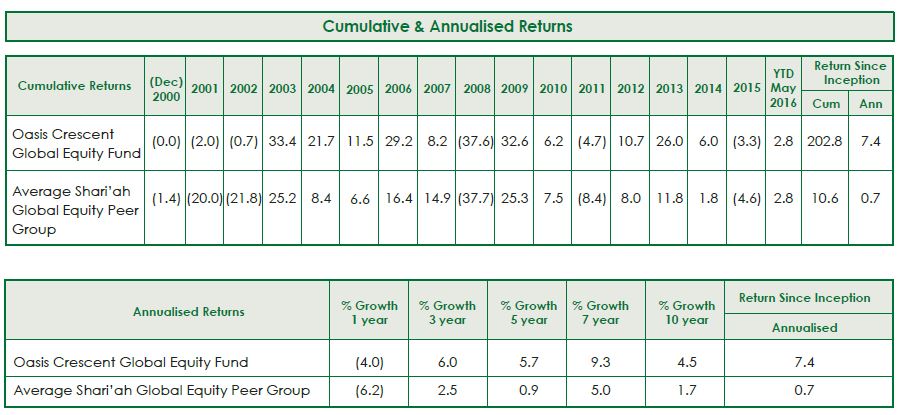

Fund performance update for May 2016 by Oasis Crescent Global Equity Fund

Article Overview

The global economy continues to undergo a number of structural changes, including those taking place in China, where the government is pursuing a host of supply-side reforms. One by-product of this is that China requires far smaller volumes of raw commodities within its aggregate production process, which has dealt a structural blow to prices across almost the entire commodity complex. Emerging market economies that have historically relied on commodity exports for the bulk of their dollar earnings, or to prop up public budgets face even further uncertainty. Adding a layer of complexity to the dynamic economic climate are the various monetary policy divergences across the so-called advanced economies. In the US, monetary policy has already begun to tighten, leading to a stronger dollar which has played its own important role in the suppression of global commodity prices. However, overall global monetary conditions remain loose on the back of further easing in Europe and Japan, and significant capacity for government support in China should provide for a continued orderly transition towards a consumer-led economy. Furthermore, the US Federal Reserve’s monetary policy committee is expected to follow a relatively shallow hiking cycle over the medium term, which should offset some global growth pressures in the near term.

Global equity markets have remained volatile over the past quarter due to continued growth concerns in developing economies and potential monetary policy normalization in the US. However, global growth uncertainty has likely resulted in the US Fed being more cautious about the speed and timing of interest rate increases while at the same time the European Central Bank (ECB) and Bank of Japan (BoJ) have continued to pump liquidity into the system, resulting in equity markets bouncing back from their lows during the quarter. In our view, the volatility during the earlier part of the year has been a reminder of the abnormal liquidity conditions that are currently present and the potential increase in volatility as monetary conditions eventually normalize. We believe investors have started to become more cognizant of risk, which is evident from the widening of credit spreads – particularly those of high yield bonds. Companies which do not have healthy balance sheets or strong cash flows have started to witness pressure on both cost and availability of funding. These dynamics emphasize the importance of investing in companies with strong competitive advantages, healthy balance sheets and the ability to generate sustainable cash flows and return on equity (ROE) through the economic cycle.

Over the short to medium term, the equity risk premium remains elevated across global equity markets due to abnormally low bond yields which are providing support to equity valuations. However, we need to be cognizant that record low bond yields (in some cases even negative bond yields) are unlikely to sustain over the long-term. With equity markets trading relatively in line with their long-term average valuations and liquidity conditions likely to eventually tighten, equity markets are likely to remain volatile. Given this backdrop, the market should start showing even greater distinction between high quality and low quality companies.

This bodes well for our portfolios which are invested in high quality market leading companies which have strong competitive advantages and the ability to generate sustainably higher cash flows and return on equity through the economic cycle. The high quality companies in our portfolio have the ability to sustain themselves during challenging economic environments, grow market share and deliver real earnings growth over the long-term. At the same time, despite the high quality, these companies are trading at a substantial discount to their intrinsic value and to the market.

Download Full Report

![]() Oasis Crescent Global Equity Fund Performance Update May 2016

Oasis Crescent Global Equity Fund Performance Update May 2016