Islamic Finance has only made substantial advances within the last decade. The Islamic banking industry, in particular, has been growing at a sustained rate, despite being at a nascent stage.

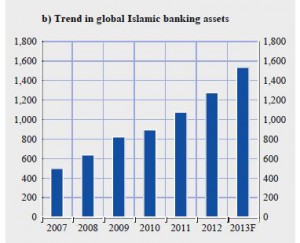

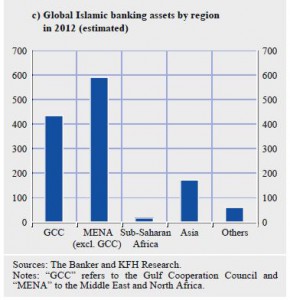

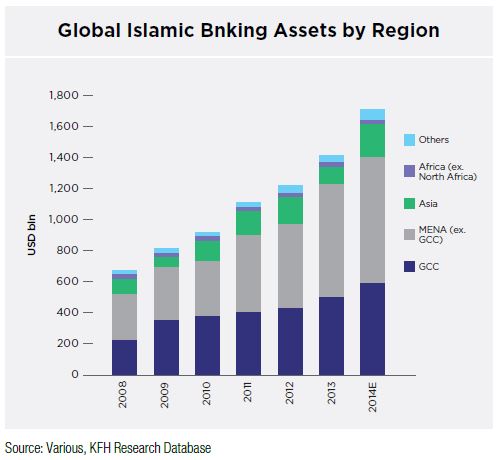

Total Islamic banking assets are expected to increase to USD1.7tln in end-2014, having recorded a Compounded Annual Growth Rate (CAGR) of 14.1% between 2009 and 2014. The largest Islamic banking markets are in the Middle East and North Africa (MENA) excluding the GCC; this region accounted for 45% of total Islamic banking assets worldwide. The GCC accounted for a 37% share, while Asian jurisdictions cumulatively made up 12%. Africa’s Islamic banking assets, while comprising just 1% of total, have grown faster than the other regions.

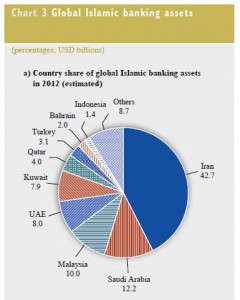

Islamic banking continues to dominate the global Islamic finance industry, representing about 80% of total Islamic financial assets. Iran, four prominent Gulf States (i.e. Saudi Arabia, the United Arab Emirates, Kuwait, and Qatar), as well as countries in South-East Asia account for most of the Islamic banking market (see Chart 3a).

Islamic banking has become the fastest growing segment of the international financial system (see Chart 3b). The internationalisation of Islamic finance makes it a potentially additional means by which intermediation can take place around the globe vis-à-vis cross-border financial flows (see Chart 3c).

So far, Islamic banks have profited from a demand-driven niche market that is fast growing. However, with the large number of Islamic banks already present and the growing interest from conventional institutions in this emerging market, the industry is becoming highly competitive (see Chart 4). Conventional financial institutions are increasingly realising the value of Islamic financing techniques and are starting to incorporate these into their existing financing practices or opening up separate “Islamic windows”.

Sources

BALJEET KAUR GREWAL, European Central Bank

Malaysia International Financial Centre (MIFC)