Article originally published in IIFM Sukuk Report, 6th Edition. Written by Islamic Corporation for Private Sector Development (ICD)

Realising Africa’s Sukuk Potential

Article Overview

Africa is on the brink of a major transformation. The continent possesses immense potential in becoming the new powerhouse of the world, underpinned by strong macroeconomic growth, a growing consumer base, strong retail markets and a young population.

With Africa’s future growth story, especially seeing that the continent is home to a quarter of the world’s Muslim population. As an alternative type of funding, Islamic finance and its inherent characteristics lend themselves well to facilitating and promoting sustainable further development in the continent.

In particular, Sukuk as an alternative means to mobilise medium to long-term savings and investments from a huge investor base, continues to be an important source of much-needed capital to meet the ever-increasing demand for sustainable infrastructure development across the globe. Sukuk has proven its viability and dynamism as a global product for fund-raising and investment activities in the international financial markets and this has been a key driver behind the interest in Islamic finance.

Sukuk Issued in The Continent

Bridging Africa’s infrastructure gap as a means of addressing the continent’s numerous developmental challenges therefore, cannot be understated. Evidence have shown that when developing countries focus on upgrading their infrastructure, economies and people’s lives will inherently transform for the better.

Ultimately, the burden of financing Africa’s infrastructure projects can shift away from banks towards the Sukuk market. In this regard, the Islamic Corporation for the Development of the Private Sector (ICD), the private sector arm of Islamic Development Bank (IDB), the largest Sharia‘ah compliant multilateral development bank in the world, continues to play an instrumental role in establishing important milestones for the development of Islamic capital markets in Africa.

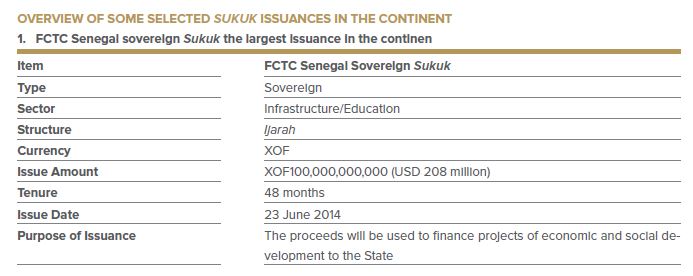

To date, Africa has witnessed a growing share of mostly sovereign Sukuk issuances. While states such as Sudan and Gambia have issued Sukuk in the past, it was in 2014 that Senegal debuted the region’s largest Sukuk issuance (USD 208 million), with ICD acting as one of the lead arrangers. Following Senegal, South Africa became the third non-Muslim country after Hong Kong and the U.K to sell government debt that adheres to Shari‘ah law by issuing a USD 500 million 5.75-year Sukuk in September 2014. Looking to emulate Senegal and South Africa’s successful move into the Sukuk market, Cote d’Ivoire have since made inaugural debuts in 2015 of USD 260 million. ICD was involved as lead arranger in all of the sovereign issuances in Africa (except for South Africa’s Sukuk).

In June 2016, Senegal launched its second Sukuk issuance, valued at USD 350 million. Accordingly, the funds raised will be used to finance Senegal’s economic and social development projects, including the urban center of Diamniadio, a drinking water supply program, and a road and street lighting program.

Togo issuance

Togo issued its maiden Sukuk worth USD 277 million with a 10-year maturity with ICD’s support. This makes Togo the third state in the West African Economic and Monetary Union (WAEMU) to issue a Sukuk after Senegal and Cote d’Ivoire.

Côte d’Ivoire issuance

Following its five-year Sukuk program with ICD, Cote d’Ivoire issued its second sovereign Sukuk valued at USD 263 million in August 2016.

Sukuk Issuances in Africa – Hope and Opportunity

Indeed, the recent sovereign issues in Africa will not only serve as an impetus for other African governments to follow suit and diversify its financing instruments via Sukuk, but it will help the Islamic finance industry to mature and expand outside of the industry’s core centres in the Middle East and Southeast Asia.

In encouraging news, it has been reported that several African countries are in the midst of preparing legislation to facilitate Sukuk issuances. In fact, the BCEAO (The central Bank of 8 countries in the WAEMU zone) have already announce that they will implement Islamic finance regulations before the end of 2017, advanced works is ongoing now with Kenya, Uganda and Tanzania to facilitate Islamic finance in their respective financial market.