Gross global cross-border capital flows have shrunk by 65 percent from US$12.4 trillion in 2007 to $4.3 trillion in 2016 (McKinsey Global Institute), a trend inline with the Islamic finance industry (IFSB). A powerful force for optimism for Islamic cross border investment to buck this trend is China’s OBOR, as stated in a Jakarta Post article by George Mickhail, a senior lecturer at the University of Wollongong.

An early indication of this OBOR boost has been three $1 billion dollar denominated Sukuk issued by Hong Kong, (issued in 2014, 2015 and 2017).

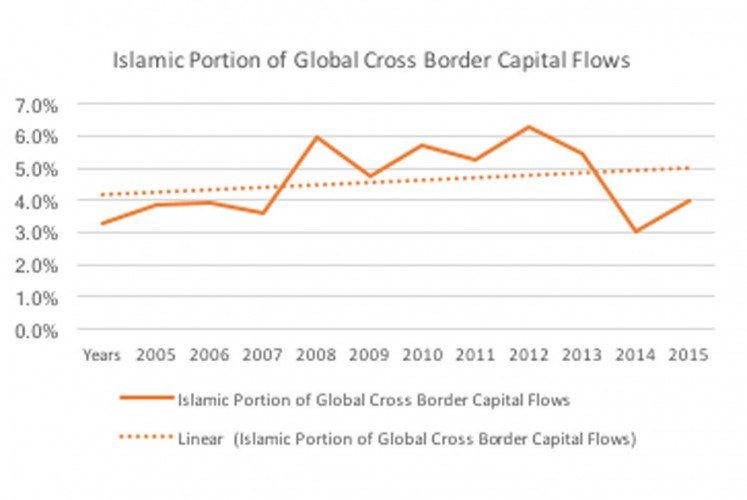

According to Mr Mickhail “The issuance of Sukuk and Sharia’ah compliant financial instruments must be viewed within the context of financing the infrastructure needs of China’s One Belt, One Road (OBOR) strategic economic partnership with its historical ‘silk road’ partners across Eurasia, where 40 percent of OBOR countries are Muslim. Recent developments in the Middle East and Southeast Asia, that are an extension of some of these forces offer a great cause for optimism that is nonetheless supported empirically by a trend incline since 2005 in the Islamic share of cross-border transactions”

He added “These initiatives are taking place against the $1 trillion investment by China in its bold, innovative and strategic OBOR project that is spanning more than 68 countries and 4.4 billion people that collectively comprise 40 percent of the global GDP.”