G20 and OECD Highlight use of Islamic Financing Instruments for Infrastructure Development

Article Overview

In a recent joint G20 and OECD paper, the use of Islamic financing instruments such as Sukuk was highlighted and a number of successful case studies referenced as a means of advancing the global investment agenda, with a focus on infrastructure development, both in terms of quantity and quality.

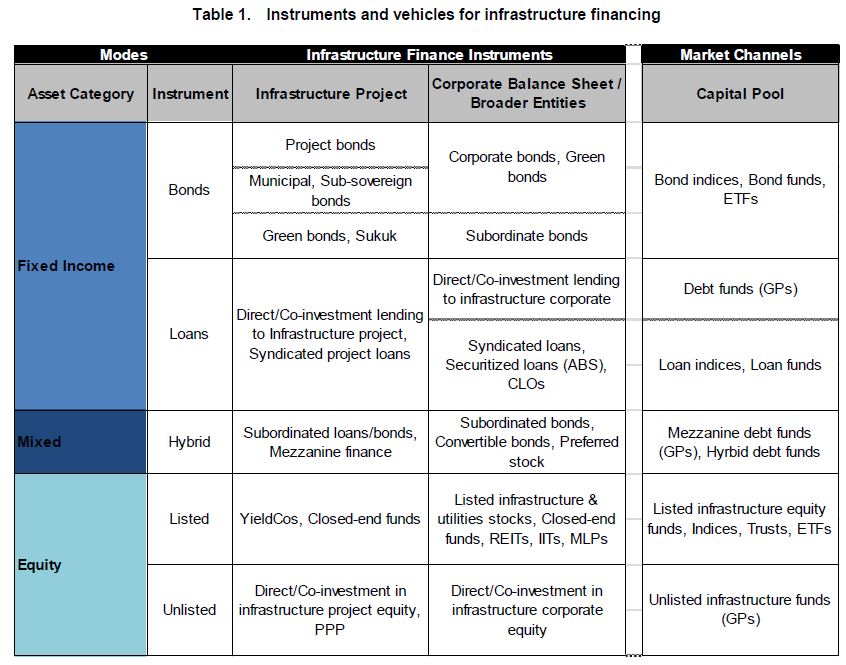

Mapping of instruments and vehicles for the financing of infrastructure

Table 1 sorts instruments based on several dimensions. The left hand margin describes modes of investment, recognizing that there are broad asset categories (fixed income, mixed, equity), followed by principal instruments. Besides the fact that investors can be creditors or equity-holders, some investments, particularly PPP contracts and concessions, may have debt-like characteristics due to contracted cash flows. Thus for consistency, categories are defined by their nature, with the distinction drawn from whether an investor receives priority claims in corporate or project cash flows (creditor), mixed (creditor with equity participation rights), or residual claims to cash flows (equity).

Sukuk may be issued by governments, MDBs, NDBs, or private entities such as corporations. There are multiple structures that can include project finance sukuk, asset-backed sukuk, sale/lease-back structures or rent/income pass-throughs. The asset-backed nature of Islamic financial instruments make sukuk well suited to infrastructure assets. Generally the underlying principal of such instruments are a sharing of risk and return amongst the parties in a transaction – cash flows are determined by incomes generated by the asset, and the return to investors is linked to the performance of the asset. In effect, sukuk resemble Public Private Partnerships due to this risk- and return-sharing arrangement.

Countries may consider the following selected actions

Develop innovative governance frameworks (including innovative forms of Public-Private Partnerships (PPP) and Islamic sukuk financing), to enable infrastructure sustainability and facilitate private financing, Strengthen institutions to ensure adequate design and transparency.

Incentives regulation in the network industries, such as setting price caps for infrastructure services, and structural reforms where there is limited or no completion, can help ensure that investment is cost reducing and mimics a fully competitive environment. Empirically, there is evidence that price-cap regulation when combined with regulatory independence boosts investment, especially in electricity grids and telecommunications networks. However, setting access prices for users of infrastructure is challenging for the regulator, with the possibility of too low a price leading to underinvestment and too high a price leading to underuse/lack of demand.

The issuance of sukuk is a growing trend in markets, but it is still in its early days. The overall trend however is for greater issuance volumes, a maturation of Sharia interpretation of the various instruments, growing levels of savings that seek Sharia compliant investments, and also growing appeal from western countries to access savings in Islamic countries. In order for this potential to be realised, regulatory, supervisory, and international coordination will be necessary in order to foster stability and to create durable interpretations of Sharia law for the finance of infrastructure.

Diversifying instruments and optimising risk allocation

Develop innovative governance frameworks (including innovative forms of Public-Private Partnerships (PPP) and Islamic sukuk financing) to enable infrastructure sustainability and facilitate private financing, including with the support of government through financing approaches such as asset recycling, land value capture, special assessment districts, and tax increment financing. Strengthen institutions to ensure adequate design and transparency.

- Indonesia has initiated further alternative access of financing for infrastructure, in particular Islamic sukuk. Indonesia’s path in developing Projects-Based Sukuk (PBS) was initiated as part of strategist in infrastructure financing and diversifying risks.

Download Full Report

![]() G20-OECD REPORT (1.12MB)

G20-OECD REPORT (1.12MB)