Report by Malaysia International Islamic Financial Centre

Technological advancement in finance provides better and faster access whilst providing newer financial transaction options. Currently, through internet and mobile banking, customers are able to execute financial and non-financial transactions from any location. As Islamic finance progresses, technology is becoming a key enabler for future business.

Financial Technology (FinTech) in Islamic Finance

Article Overview

The digital technology has expanded to include more innovation in the financial sector, such as innovations in financial literacy and education, retail banking, and investment. Thus far, the financial technology industry has grown exponentially since 2011, and in 2015, the financial technology industry saw a USD16.5bln of funding, with a 22.2 percent y-o-y funding growth. To date, there are over 600 IFIs operating in about 75 countries across the globe ranging from banking, takaful to capital market. Therefore as Islamic finance progresses, technology is becoming a key enabler for future business. IFIs offering Shariah-compliant products need a dedicated end-to-end Islamic banking system that facilitates and automates Shariah-compliant banking operations and enables banks to scale up their operations to meet global competition, grow market share, retain the loyalty of their customers and of more importance, enhance their profitability.

Usage of FinTech in Selected Islamic Finance Jurisdictions

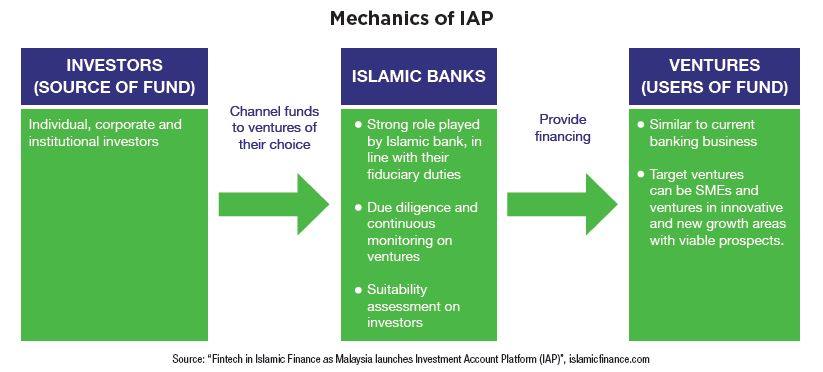

In key Islamic finance jurisdiction such as Malaysia, as part of the continued innovation of Islamic financial products, the country has recently launched an Investment Account Platform (IAP) which is envisaged to become a cross-border multicurrency channel linking into regional and global economies.

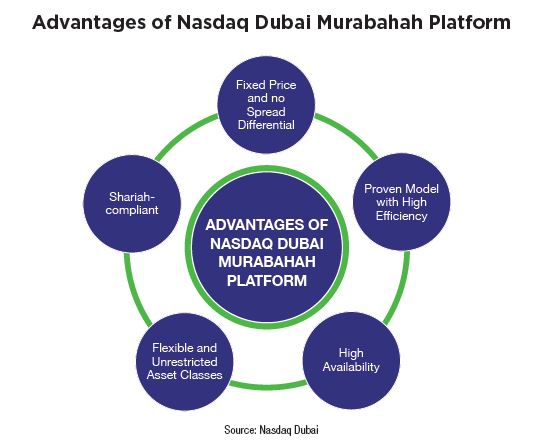

The Dubai Multi Commodities Centre (DMCC) Commodity Murabahah Trading Platform (CMTP) is an initiative which enables electronic transfer of ownership and possession through tradable warrants. Through CMTP, it provides a holistic solution to the Islamic finance industry through a fully electronic commodity murabahah trading platform with a complete transfer of ownership and possession of locally stored Shariah compliant commodities in accordance with the applicable laws. Apart from DMCC CMTP, Dubai in collaboration with Emirates Islamic (EI) and Emirates Islamic Financial Brokerage (EIFB) offers the Nasdaq Dubai Murabahah Platform – an online platform for Islamic financing. The platform utilizes Shariah-compliant certificates which are based on wakalah investments that have been developed as the underlying asset for all the financing transactions.19 Through the online platform, Islamic banks, Islamic windows and Islamic finance companies can offer cash financing to customers in an efficient, fast and flexible manner.