Investment Account Platform (IAP) envisaged as Cross Border Multi Currency Channel

Article Overview

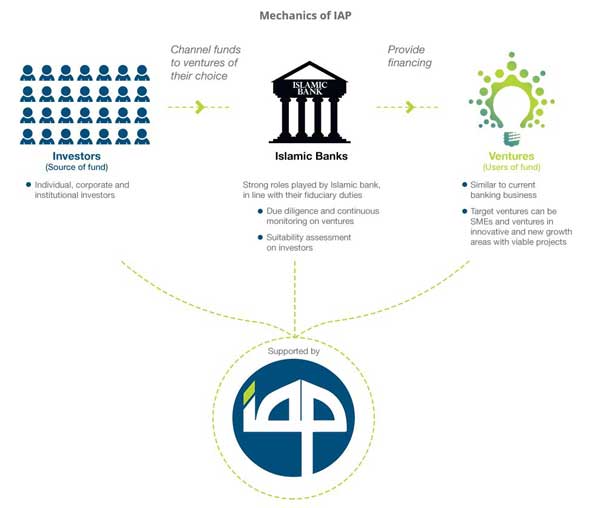

Malaysia continues to lead in the innovation of Islamic financial products with the recent launch of an Investment Account Platform (IAP) which is envisaged to become a cross border multi-currency channel linking into regional and global economies.

The Islamic finance market is currently characterised by a collection of domestic markets with little cross border activity, and faces challenges of financial intermediary, that of effectively matching investors seeking Sharia compliant opportunities to businesses seeking funding.

Speaking at the launch of the IAP product, Dr Zeti Akhtar Aziz, Governor of the Central Bank of Malaysia (Bank Negara Malaysia) stated the IAP is “more than a new and innovative medium for Shariah-compliant investments and fund raising initiatives”, but “signifies a fundamental shift towards providing solutions that addresses the prevailing gap in the current risk-transfer financial regime to one that now allows for financial institutions to include a wider range of investment intermediation activities that emphasises risk-sharing and thus facilitate a stronger linkage of finance and the real economy.”

IAP Value Proposition

The IAP will provide investors with direct access to a broad range of investment opportunities, and businesses as well as Islamic banks with a new source of funding. Dr Zeti added “There is also the potential for institutions with specific mandates including Government agencies to strategically collaborate with the IAP and Islamic banks to form public-private partnerships to facilitate the efficient channelling of grants or funding and to facilitate financing opportunities for identified strategic ventures.”

Malaysian Islamic Finance Ecosystem

During her speech, Dr Zeti highlighted the development of the Islamic financial system in Malaysia and referred to it as a “complete Islamic financial ecosystem” which operates alongside the conventional financial system. The growth of the ecosystem has been supported by a robust Shariah, legal and regulatory framework which has allowed it to exceed a target of 20 percent market share by2010.

The Islamic Financial Services Act 2013 (IFSA) “provides the industry with the foundation to transition into its next stage of development”, added Dr Zeti.

A key part of the act allows for Islamic banks to diversify their businesses through the offering of investment accounts as an alternative means of raising funds from the public, thereby allowing them to pursue their role as investment intermediaries in which the alternative modes of risk-sharing contracts can be applied for the investment account.