Report by Malaysia International Islamic Financial Centre

Islamic Fund and Wealth Management Sector on the Rise

Article Overview

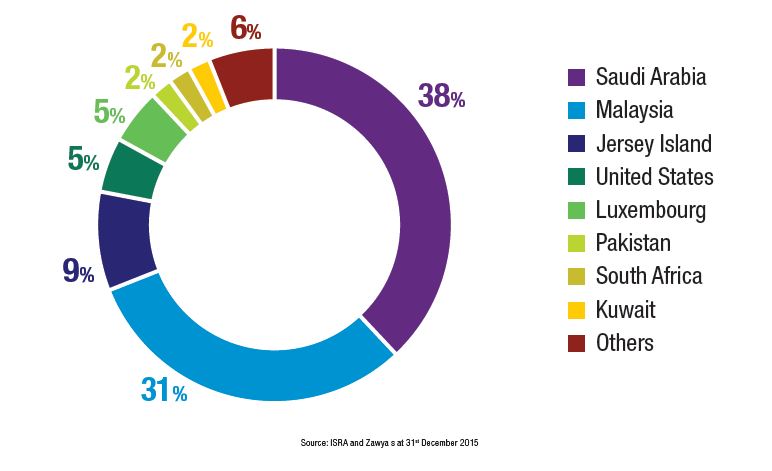

To date, the global Islamic fund and wealth management sector is on the rise, supported by strong demand from Muslim and non-Muslim investors. Globally, the wealth of high net worth individuals (HNWIs) grew by 14 percent to reach USD52.6tln in 2013. Key Islamic finance jurisdictions such as the Middle East and Africa private wealth increased 11.6 percent to USD5.2bln in 2013. As at 4Q2015, the total global Islamic assets under management (AuM) were USD58bln and the number of Islamic funds stood at 1,053.

As the global Islamic fund and wealth management sector continued to experience growth due to the increasing affluence of Muslim communities who wish to invest surplus funds in a Shariah-compliant manner and non-Muslim investors’ wish to diversify their investment through Shariah-compliant funds, more innovative and comprehensive products and services are being offered. One such possibility is Islamic Wealth Management (IWM). IWM which is relatively a new area of operations of the industry is seen as service that best caters to these growing needs.

History of Islamic Wealth Management (IWM)

The historical root of IWM can be traced back to the basic Islamic concepts of wealth and extends to the various structures of Islamic financial products and overall planning. Shariah defines five (5) necessities as necessary and basic for human existence, and it is the duty of every society to preserve and protect the five (5) necessities: religion, life, intellect, progeny, and property. Hence, this explains the need to manage wealth in accordance to Shariah.

The wealth management cycle involves the creation of wealth through (inter alia) a business, profession or trade and/or savings with financial institutions, the enhancement of wealth to generate returns, the protection of wealth through risk management, takaful and trusts, and the distribution of wealth through gifts (hibah), wills and trusts. Therefore, IWM is concerned with providing end-to-end solutions using products and services throughout the wealth management cycle which are in compliance with Shariah. The range of activities comprises financial analysis, Shariah

compliant asset and securities selection, investment planning and ongoing monitoring of investments, as well as estate planning, tax planning and retirement planning. In short, it is a comprehensive Shariah-based service.

Role of Islamic Financial Institutions (IFIs) in Wealth Management

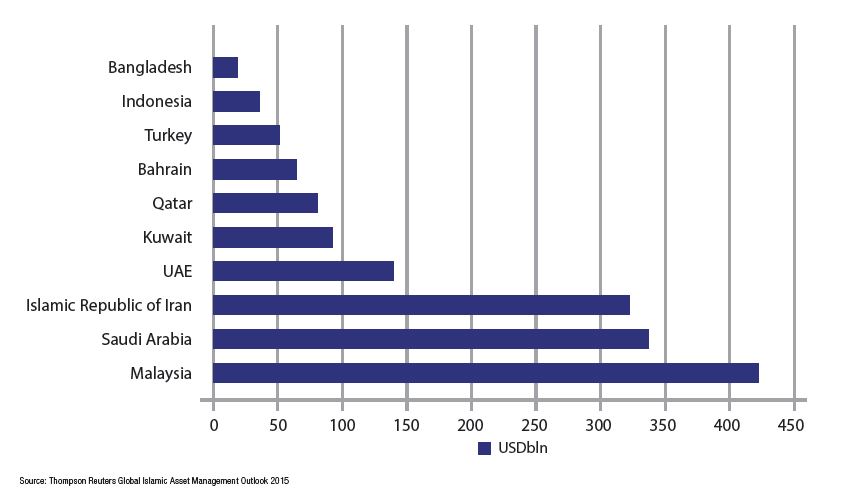

Presently, most IFIs are offering retail services; nevertheless their involvement in IWM is increasing. This is because as the wealth of their clients grows, they are demanding access to private banking facilities. Globally, there are 993 IFIs operating in around 100 countries; with approximately USD1.658tln in Islamic assets. In addition, OIC-member countries altogether represent 10 percent of the global GDP, signalling wider investment opportunities.

Download Report

![]() Islamic Wealth Management – Growing Stronger Globally (6.5MB)

Islamic Wealth Management – Growing Stronger Globally (6.5MB)