Report by Malaysia International Financial Centre Report

MIFC have released two reports covering the Islamic Investment Funds Industry

Article Overview

Islamic Funds Industry – 2015 Review and Outlook

In 3Q 2015, total global Islamic assets under management (AuM) stood at USD60.2 billion. The sector is conservatively projected to grow by 5.05% per annum for the next five years to reach USD77 billion in value by 2019. This is substantiated by a number of facts, such as the average growth rate of Islamic funds at 9.55% per annum over the past five years.

Islamic financial products have evolved and developed considerably from simple and straightforward structures to sophisticated and multifaceted instruments. While Islamic financial products and services offered in the 1980s-90s were dominated by deposits and savings products, syndicated project financing as well as Shariah-compliant stocks, the last decade has witnessed the unveiling of more sophisticated structures, including various Islamic investment funds such as Islamic exchange traded funds, Islamic money market, Islamic real estates, and real estate investment trust. This evolution is underpinned by the maturity and complexity of market alongside more sophisticated and demanding investors.

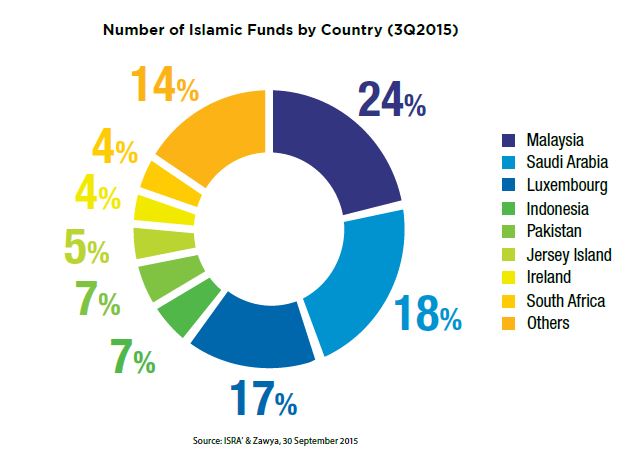

In 3Q 2015, the total of global Islamic asset under management (AuM) stood at USD60.2 bln, posting a decrease from the previous year AuM of USD75.8 bln (3Q 2014). The number of Islamic funds declined to 1,030 from 1,161 for the similar period last year. This is mainly due to the decline in oil prices and the rapid changes in the global regulatory framework which substantially affect the overall growth of the Islamic finance industry. Notwithstanding this, the sector is projected to register an annual growth of 5.05% per annum for the next five years and estimated to reach USD 77 bln by 2019.

SRI and the case for Islamic Investment Funds

A detailed e-book covering the following sections:

- Foundation and Growth of Investing Through Principles

- Definitions, Strategies and Drivers

- Why are Investors Increasingly Attracted to SRIs?

- Emerging Markets & Islamic Investment

- The Malaysian Option

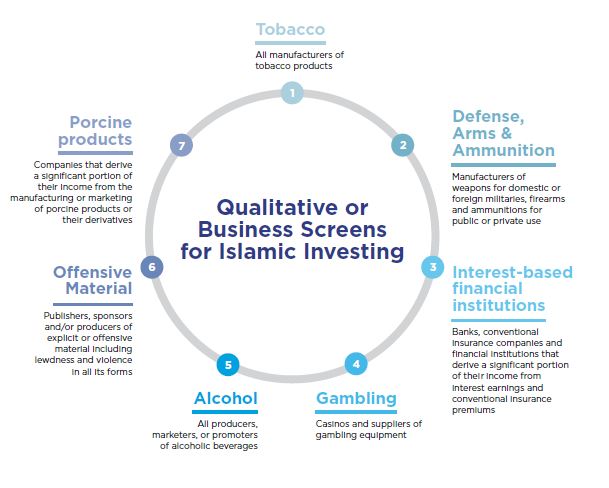

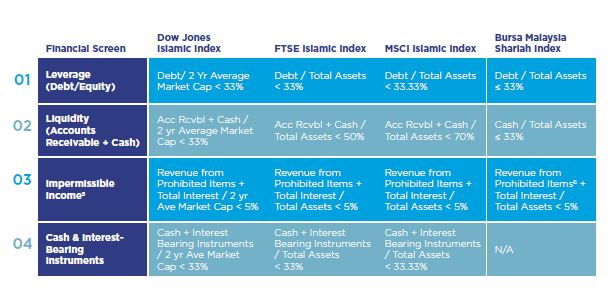

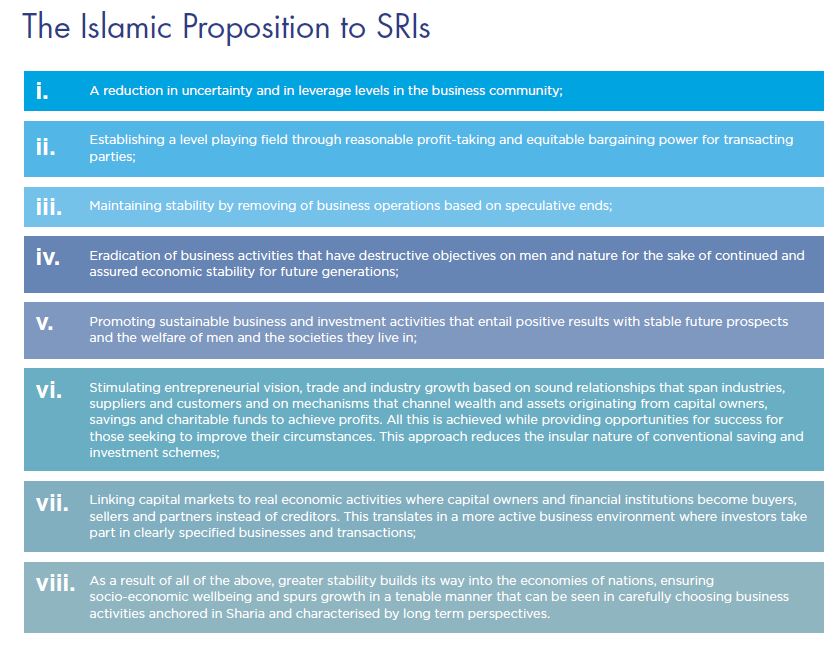

The report provides a great overview of using Islamic investment screens for investment portfolios covering qualitative and quantitative screens.

Download Reports

![]() Islamic Investment Funds Outlook (792KB)

Islamic Investment Funds Outlook (792KB)

![]() Islamic Investment Funds (4.66MB)

Islamic Investment Funds (4.66MB)