Report by Malaysia International Islamic Financial Centre

Islamic Finance: Development in Non-Traditional Markets

Article Overview

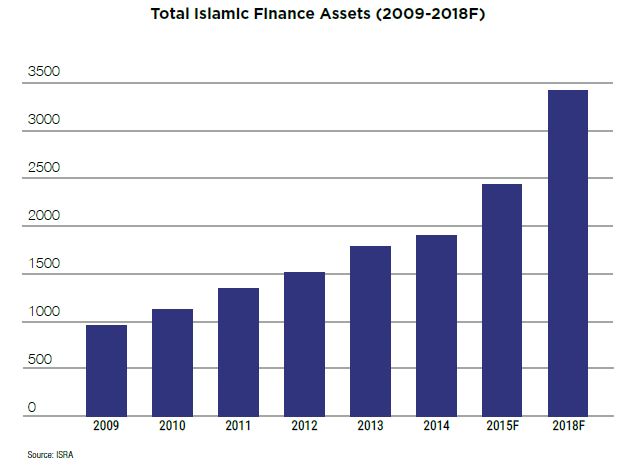

In just four decades, Islamic financial system has evolved into a comprehensive financial system of its own: ranging from banking, capital markets, to takaful sectors. To date, total global financial assets of the Islamic financial industry are estimated at USD2tln and are expected to surpass USD3tln by 2018.

The most significant players remain the Gulf Cooperation Council (GCC) countries and parts of South East Asia. In these countries, Islamic finance accounts for a sizeable and growing share of the domestic banking sector, catering to both large corporate clients and household financing.

Meanwhile, non-traditional markets for sectors. To date, total global financial assets of the Islamic financial industry are estimated at USD2tln and are expected to surpass USD3tln by 2018. Islamic finance are emerging, with African countries launching debut sovereign sukuk and East Asian countries enabling their domestic markets to tap into Islamic finance. In addition, European banks in Russia and Germany are also investing in Islamic finance through debut sovereign sukuk and Islamic banking windows.

Islamic Finance Offerings in Non-Traditional Markets

Presently, Islamic finance industry’s geographical presence has grown beyond its traditional markets in the Middle East and South East Asia and includes new players from diverse regions such as Africa, East Asia, North and South America and others.

Africa

The future growth prospects of Islamic finance in the African region are promising on the back of recent developments and initiatives in several new and niche Islamic finance markets.

East Asia

In The East Asian powerhouses such as Japan, South Korea, Hong Kong and China have also show interest in developing Islamic banking markets locally as well as to create opportunity for issuers to tap the sukuk market via their shores.

North and South America

In the North American region, Islamic finance is being touted as the next big thing for Canada’s financial services sector.

Other Potential Markets

Apart from the new frontiers highlighted above, other countries such as Russia and Germany are also showing keen interests in Islamic finance.

Download Full Report

![]() Islamic Finance Development in Non traditional Markets (921KB)

Islamic Finance Development in Non traditional Markets (921KB)