Commentary by RHB Global Sukuk Markets Research, Kuala Lumpur, Malaysia

Fresh Sukuk supply post-Fed meeting; sovereigns most likely to dominate in 2016.

Article Overview

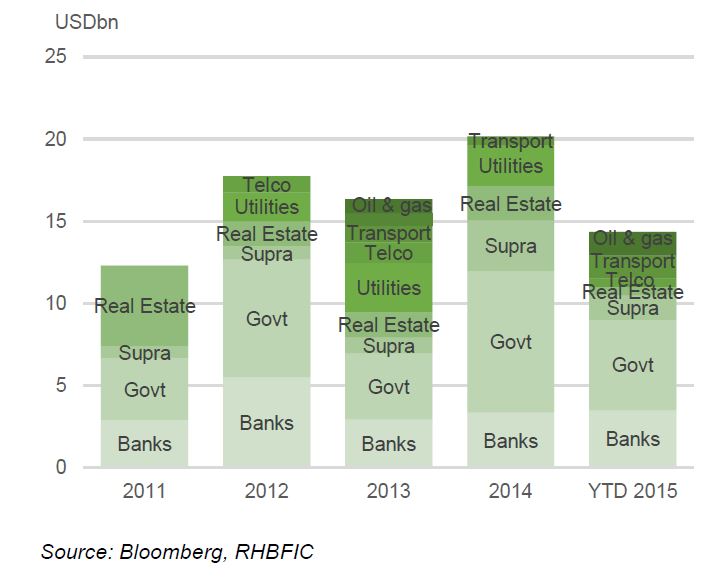

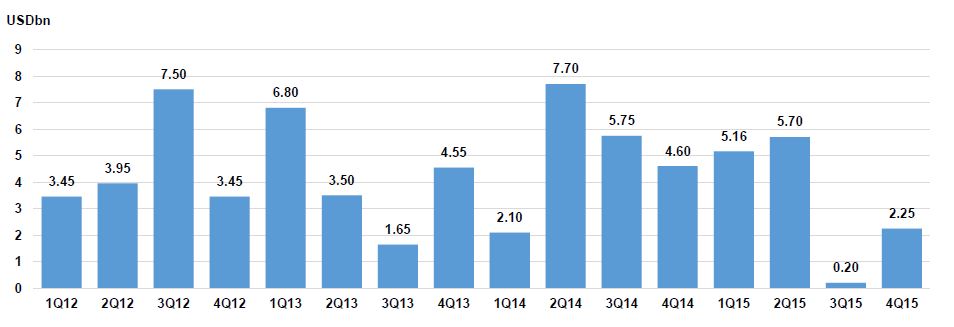

Qatar Islamic Bank (QIB), Arab Petroleum Investments Corp. (APICORP), Majid Al Futtaim (MAF) and Axiata added supply in the USD space, possibly to take advantage before the Fed first adjustment next month. In the pipeline, Turkey (c. USD1bn) could tap the market again besides Luxembourg (c. USD200m), Egypt (not indicated, c.USD300m), Pakistan (c.USD500m), Kazakhstan (c.USD1bn) and SOE-Aluminum Bahrain (c.USD1bn) with total of c.USD3bn, based on our estimate. We continue to believe that governments will hold reign of supply in 2016, indicated by announcements as well as historical trends.

Sovereign Update

Islamic Development Bank (IDB) (Aaa; Sta/AAA; Sta/AAA; Sta)

The reconstruction of Yemen may require Sukuk issuance, in partnership with the World Bank, according to Ahmed Mohamed Ali, President of IDB, at a Kuwait industry conference. We could see IDB and World Bank being joint issuers. IDB and World Bank launched an initiative in Oct-15, prioritizing the refugee crisis and reconstruction financing for countries facing conflict, e.g. Syria, Iraq, Yemen and Libya. However, priority is on rebuilding infrastructure in Yemen.

The World Bank vice president for Middle East and Europe Hafez Ghanem highlighted in Oct-15 that expressions of interest had come from G7 countries and other European countries for this initiative. IDB and the World Bank have previously raised over USD7bn together and targeted 72 projects primarily in the infrastructure sector from 26 countries in Asia and Africa.

Kazakhstan (Baa2; Sta/BBB; Neg/ BBB+; Sta)

The central bank, National Bank of Kazakhstan, plans debut sovereign Sukuk of USD1bn in 2016, from its USD3bn programme. This comes after its parliament approved legislative amendments to facilitate Islamic finance. According to the IMF, the government’s primary fiscal deficit is estimated to widen to 3.7% of GDP in 2015, and expected to ease to 0.7% in 2016. Gross debt is forecasted to jump to 18.3% of GDP in 2015 (from 14.9% in 2014) and continue to rise to 18.8%.