Commentary by RHB Global Sukuk Markets Research, Kuala Lumpur, Malaysia

Sukuk return has been on an upward trajectory since 2009

Article Overview

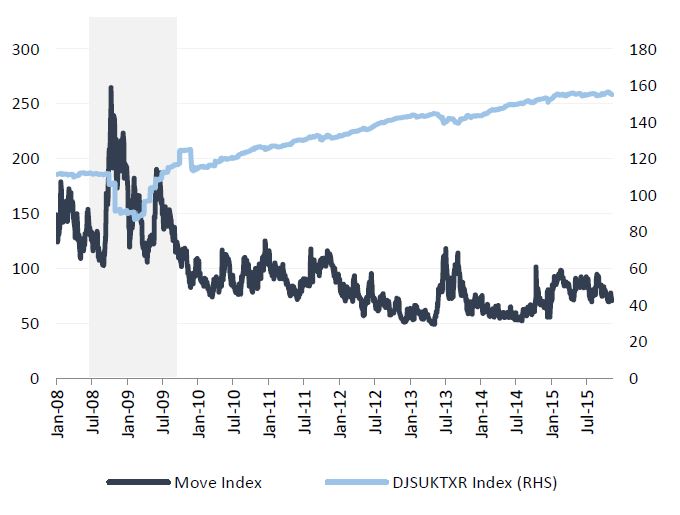

Such a relatively stable rate of return was partly due to the structure of Islamic bonds which have strong link with their underlying assets, allowing the instruments to escape the danger of excessive speculation. Since the onset of the 2008 Global Financial Crisis, the DJSUKTXR index has been recovering from its record low of 86.7 while Merrill lynch Option Volatility Estimate (MOVE) Index, the de factor benchmark for bond market volatility broke an unprecedented level of 180. A simple correlation analysis suggests both indices have a mildly strong negative relationship of 0.66 while exhibits stronger relation during periods of very high implied volatility. Nonetheless, the DJSUKTXR index has seen a quick recovery and continued to gain at a rate of return of c. 5.2% between 2009 to YTD.

Hence, we believe Sukuk would continue to offer a more stable return compared to conventional bonds. In fact, Sukuk has recorded a YTD return of 1.6% (2014: +6.4%) versus -0.70% recorded by conventional bonds (2014: 7.6%).

Highlights and Performance

Brent oil tumbling below USD45/bbl induced volatility to the Sukuk market.

The Bloomberg Malaysia Sukuk Ex-MYR Total Return (BMSXMTR) and Dow Jones Sukuk Total Return (DJSUKTXR) indices ended lower to close at 101.53 (-0.09% w-o-w) and 154.9 (-0.23% w-ow) respectively.

CDS spreads widened with the exception of Malaysia which ended tighter at 182.5bps.

CDS widened the most for Bahrain, adding 14.9bps w-o-w to 336.9bps after Bahrain resorted to further borrowings in USD to plug its budget shortfall. Saudi Arabia’s inflation accelerated to 2.4%while the non-oil foreign trade exports weakened to -31.7% from -19.0% in August, signaling further pressure on Saudi economy and led its CDS to sink to its weakest point this year of 157.2bps (+8.7bps w-o-w).

Credit Updates

Sharjah Islamic Bank (SIB) A3/BBB+/BBB+; Sta

Moderate growth due to slower income from Murabaha, leasing and subsidiary companies. 9M15 net profit grew 1.2% y-o-y to AED298.4m from AED295.0 while NIM declined to 2.2% from 2.6%. Loans-to-deposits ratio has been hovered around 100%, with current level of 100.9%.

RHBFIC View: SIB’s credit metrics to remain stable given its (1) high likelihood of support from Sharjah government, with 31% ownership through Sharjah Asset Management LLC in the company; and (2) strong capitalization, with Tier 1 capital ratio and CAR of 23.4% and 23.9% in 2014. However, these were moderated by weak asset quality metrics, with NPL of 7.4% and coverage ratio of 51% as at Dec-14.SIB 5/16 and 4/18 ended the week with yield widened by 21bps w-o-w and 4bps w-o-w to 1.33% and 2.41% respectively.

Albaraka Turk Katilim Bankasi AS (Albaraka) NR/BB;Neg/NR

Stronger earnings but moderated by weaker asset quality and capitalization metrics. Albaraka’s net profit surged 15.8% y-o-y to TRL211.9m in 9M15 on higher profit share income while NIM declined to 4.13% from 4.32%. The bank’s NPL and provision coverage ratios weakened to 2.6% and 70.5% respectively (2014: 2.0% and 87.9%). Loans-to-deposits ratio improved to 94.9% as at Sept-15 in comparison to 97.2% as at Dec-14.CAR declined to 12.1% as at Sept-15 from 14.2% owing to high loan growth of 19.9%. Separately, Albaraka plans to issue Basel III USD400m10y Tier 2 Subordinated Sukuk.

RHBFIC View: Negative. The bank’s debt-to-EBIT has materially increased from 11.7x in 2014 to 15.6x in 3Q15. Its leverage position would be weaker upon issuance of the proposed Basel III paper and EBIT remaining at a moderate level. ALBRK 6/19 was last priced at 6.06% (+23bps w-o-w).