Corporate Sukuk in Europe

Article Overview

A report produced by Deloitte highlights Islamic capital market developments in Europe. The report also includes perspectives of prominent industry thought leaders and practitioners who shared their insightful views on the discussed issues.

Emerging Trends

Key points presented in the report cover the United Kingdom, France, Germany, Turkey, Luxembourg and Ireland.

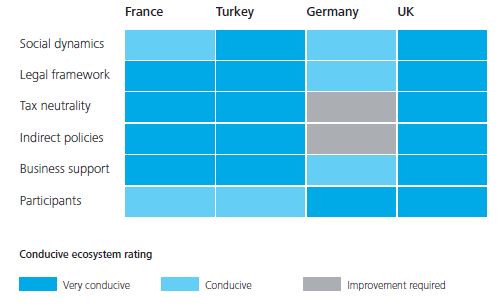

- Governments in several European jurisdictions are attempting to provide level playing fields for Islamic finance practice. Some have gone a long way such as the UK, Luxembourg, and Ireland. Others are striving to match the regulatory developments in these countries and have provided good breakthroughs in changing national regulatory frameworks to host the industry, in particular, Turkey, Germany, Italy and possibly Spain, and to some degree France.

- Constrained professional and industry dialogue between corporate professionals and investment bankers, widening knowledge and awareness gaps of Islamic Finance amongst the market players.

- The observational analysis enforces good market sentiment amongst practitioners and market players. The general perception is optimism for great growth in this market in the next few years, depending on the improvement of global market conditions.

Key Findings

The survey’s key findings reveal that:

- 91% of respondents have considered ethical investments in Sukuk.

- 73% of respondents would consider Sukuk and another 25% might consider the instrument depending on its merits if the transaction entailed any tax benefits.

- The majority of respondents prefer equity followed by Sukuk over all other proposed asset categories.

- Stakeholders are more likely to dedicate a smaller percentage bracket of their Capex to Sukuk.

- 81% of participants prefer to invest in USD denominated Sukuk.

- 75% of respondents would still consider investing in Sukuk even with lower/similar yields than other bonds.

- 55% of respondents would definitely consider Sukuk as a tool to reduce risk and diversify their portfolio, with another 34% speculative.

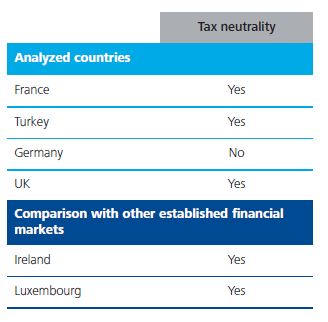

Tax neutrality

Amendments to tax laws, in order to establish tax neutrality for Islamic Finance transactions and instruments, create a level playing field between conventional and Islamic financial products. Inequality of tax treatment arises in Islamic Finance transactions due to a sale or exchange of the underlying asset to the SPVs, triggering capital gains, stamp duty, and withholding income taxes depending on where the asset owner is located in a foreign jurisdiction. Providing tax incentives could reduce the hidden costs of issuing Sukuk and encourage more enterprises to issue or invest in them.