Statement from BLME Plc

Article Overview

BLME Holdings plc Interim Management Statement – Q3 2015

London, 12 November, 2015 – BLME Holdings plc today issues its Interim Management Statement relating to the nine month period ended 30th September 2015. All statements in this release relate to that time period, unless otherwise indicated. These results have not been audited or reviewed by the Group’s auditor, KPMG LLP.

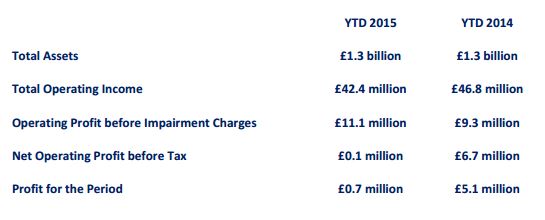

BLME Holdings plc has increased Operating Profit before Impairment Charges by 19%. Total Operating Income has reached £42.4 million for the period with Net Fee Income of £3.0 million and Operating Profit before Tax for the Group of £0.1 million.

Total Operating Expenses for the period were £31.2 million compared to £37.6 million for the same period in 2014, a reduction of 17%, resulting in a Cost Income ratio of 66.3% (after adjusting for operating lease depreciation). BLME’s Balance Sheet remains stable with Total Assets at £1.3 billion. The Group has a good pipeline of new business across the Bank.

Adel Al-Majed, Chairman of BLME Holdings plc, commented on the results: “”BLME’s results are as expected as the Group has realigned its strategy and addressed legacy issues. I am encouraged by the Bank’s management of Expenses and the overall progress being made.” Michael Williams, CEO of BLME Holdings plc, said: “Despite a typically quiet third quarter with modest activity due to the summer period and Ramadan we have managed to increase our Operating Profit before Impairment Charges. We are encouraged to note increasing opportunities, particularly in our wealth management businesses and the Bank is well positioned for 2016.”

About BLME

BLME is an independent wholesale Sharia’a compliant bank based in London and is a leading provider of finance to the UK mid-market. BLME received FSA authorisation in July 2007 and is the largest of its peers in Europe. BLME is led by a management team that brings together a combination of experienced international bankers and leading experts in Islamic finance. BLME has three key business areas; Corporate Banking, Treasury and Wealth Management, providing a wide range of financing solutions and investment opportunities.

- Corporate Banking consists of four business units, Property Finance, which includes the funding of investment and

development properties; Leasing which provides finance primarily for the UK market; Corporate and Structured

Finance which funds corporate growth and acquisition; and Asset Backed Finance which includes ABL structured

facilities and trade finance. - Wealth Management consists of Private Client Services and Asset Management.

- Treasury which funds the financing activities in Corporate Banking and Wealth Management, provides BLME’s Premier Deposit Accounts and manages the Group’s capital and liquidity.

BLME is dedicated to offering innovative Islamic investment and financing products to businesses and high net-worth individuals in the European, US, Asian and MENA regions. To ensure that BLME’s services and operations are wholly Sharia‘a compliant, the Bank has a dedicated Sharia‘a Supervisory Board (“SSB”). The SSB’s role is to review contracts and agreements relating to all transactions ensuring that they are consistent with the principles of Islamic jurisprudence.

About Islamic banking

Islamic finance upholds the principles of fairness, integrity and transparency. The principle of fairness is reflected in the risk and reward-sharing element that forms the foundation of every Islamic financial transaction. Islamic finance aims to create business activities that generate a fair and equitable profit from transactions that are backed by real assets. This method of financing avoids speculation, short selling and excessive credit creation whilst encouraging sound risk management procedures. Islamic banking has a robust system of risk management and self-regulation to ensure that each transaction is transparent and that the appropriate due diligence and higher standards of disclosure required are observed. To ensure compliance with these requirements each transaction and agreement is reviewed and approved by a Sharia’a Supervisory Board. This Sharia’a specific regulation and governance is in addition to the conventional regulation that applies to all UK based financial institutions