Comcec Coordination Office, October 2015

OIC Member States to Maintain Economic Growth

Article Overview

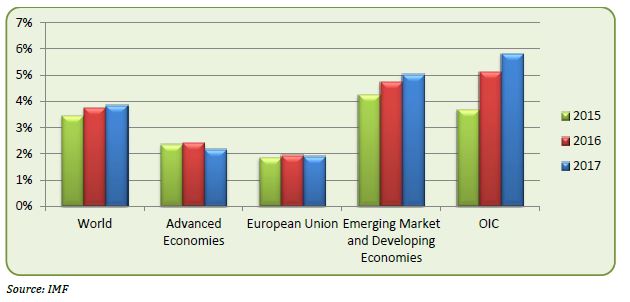

Despite the lowering commodity prices, tightening global financial conditions and possible higher interest rates, OIC Member States will maintain economic growth next two years. Thus, it is expected that OIC Member States average economic growth rate will accelerate in 2016 and 2017 with 5.1 and 5.8 percent, respectively.

Financial Access

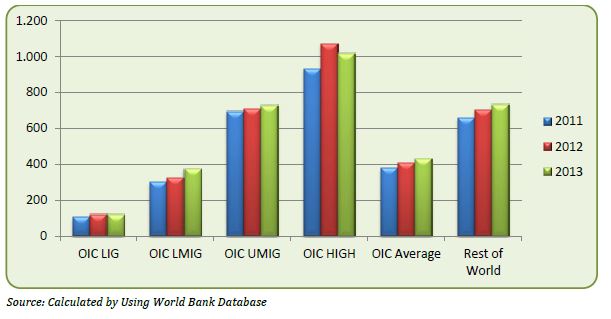

The data indicates that, the OIC Member States have significant potential needs to be realized regarding basic financial services such as having bank account. Therefore banks in the OIC Member States should try to outreach every part of the society and offer at least basic services to them.

Islamic Finance

Given the industry’s current size and composition, although Islamic finance is still a niche market in the overall global financial industry, it has become an important part of the international financial system and was, certainly, one of its fastest growing components over the last decades.

Although the industry has enjoyed abovementioned growth, its sustainability and future growth will largely depend on how successful it is in addressing the challenges at both macro and micro level such as numerous issues concerning its theoretical foundation, infrastructure development, systemic implementation, integration with external systems, and enhancing operational efficiency. If due attention is not paid to addressing these issues, Islamic finance will fail to achieve its full potential and to deliver on its promise. Therefore, the stakes are very high and demand serious discussion of the issues.

Islamic Finance Outlook

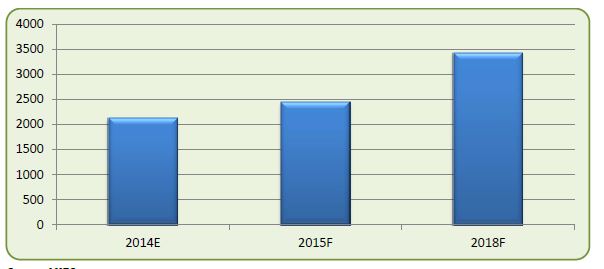

The current value of the Islamic Finance assets, led by the Islamic banking sector and the global sukuk market, is estimated to be more than $2 trillion (compounded average growth rate, CAGR 2019-2014: 17.3%). It is expected that the industry will expand further, with total assets projected at nearly $ 3.5 trillion by 2018.

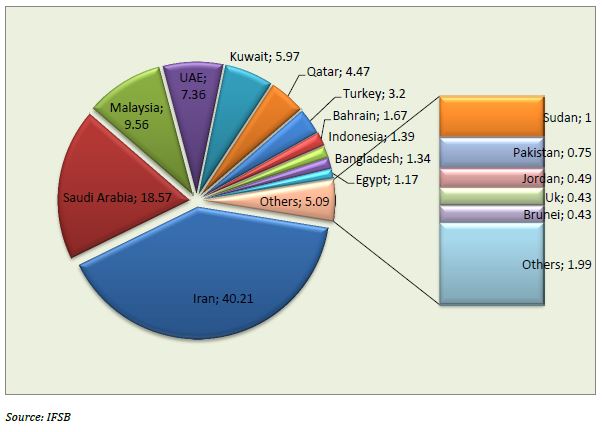

The Islamic Financial Assets mostly concentrated in some regions (particularly Middle East and Far Eastern Asia) of the world. On the other hand, Islamic finance has made important strides into advanced economies in the US, Europe and Asia – most notably through Islamic capital market instruments.As of 2013, the top 5 jurisdiction for Islamic Finance are: Malaysia ($423 billion), Saudi Arabia ($338 billion), Iran ($323 Billion), United Arab Emirates ($140 billion) and Kuwait ($92 billion).

Participation Banking Sector

As the largest segment of the global Islamic finance industry, the total asset of the sector is estimated as -approximately- $1.48 trillion as at 1 half of 2014, and is estimated to amount approximately $1.56 trillion by the end of the 2014. The asset size of the industry put forth that there is a huge gap between the potential and existing Islamic Finance market, the 2014 potential of the Islamic banking universe would be $4.178 trillion in assets within the OIC. The CAGR between 2008 and 2013 was 16.89%. The industry grew by 16% in 2013 annually while assets of the top 1000 global banks grew by only 4.9% in 2012 and 0.6% in 2013.

Download Full Report

Comcec Financial Outlook for OIC Member Countries ![]()