![]()

Commentary by RHB Global Sukuk Markets Research, Kuala Lumpur, Malaysia

Disappointing Chinese and US data boosted Sukuk returns but tempered by unimpressive momentum.

Article Overview

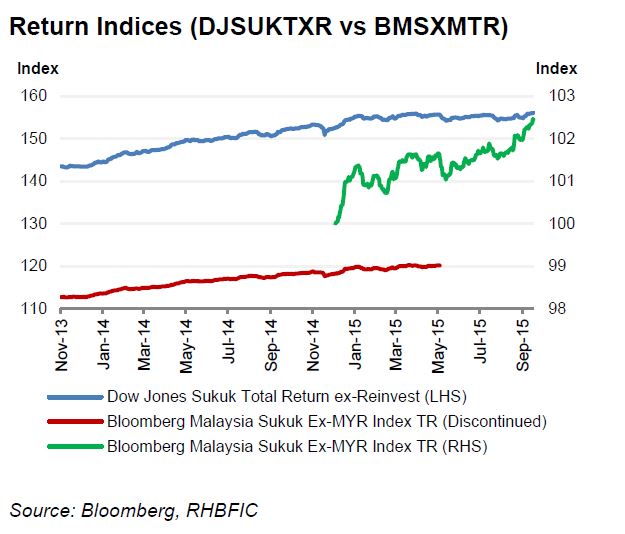

The Bloomberg Malaysia Sukuk Ex-MYR Total Return (BMSXMTR) index rebound another 0.20% to 102.4; while the Dow Jones Sukuk Total Return (DJSUKTXR) index posted a 0.22% pick up to 156.1 from 155.9 a week earlier. Interest appeared titled towards Malaysian and Saudi credits, with IDB Trust Services 18 & 19 (Aaa /NR/AAA; Sta) and MALAY 21 & 25 (A3/A-/NR) trading at +USD3.2m in market capitalization. Weighted average yield closed 3.4bps tighter at 2.24% as market continues to speculate a delay in Fed liftoff until 2016 over weaker Chinese import of -17.7% YoY (which deepen concerns on global demand) and slower US retail sales of +0.1% vs. prior month of +0.2%, although core inflation rate edged up to 1.9% y-o-y (Aug: 1.8%; Fed’s target: 2.0%), in our opinion.

Pressure on GCC countries’ CDS amid rising geopolitical tension over Iranian threat.

The credit protection costs for Bahrain widened the most in GCC region by 17.6bps to 314.3 as compared to Abu Dhabi (+3.7bps to 74.7), Saudi Arabia (+2.9bps to 127.9), Dubai (+2.5bps to 193.4) and Qatar (+1.3bps to 73.4). However, an opposite trend was seen across Indonesia, Malaysia and Turkey to close at 213.5 (-13.9bps), 200.0 (-6.9bps) and 268.8 (-1.2bps).