Commentary by RHB Global Sukuk Markets Research, Kuala Lumpur, Malaysia

Sukuk Gain Marginally

Article Overview

Sukuk gained marginally c.0.04%; yield rose to 2.353%. The Bloomberg Malaysia Sukuk Ex-MYR Total Return (BMSXMTR) ended flat (+0.04% WoW) at 101.63 (week prior: -0.22% to 101.59), with weighted average yield widening 1.0bps to 2.353% (week prior: +5.9bps to 2.343%). On the contrary, the Dow Jones Sukuk Total Return Index (DJSUKTXR) retracted by 0.16% to 154.55 (week prior: -0.43% to 154.8). Top 5 performers in the BMSXMTR were SECO 4/24, SECO 4/23, KFINKW 10/16, QATAR 1/23, and SECO 4/22 gaining USD11.5m in value; while underperformers were ISDB 1/17, RAKS 3/25, MALAYS 7/21, MALAYS 4/25 and FGBUH 8/16 shaving USD19.4m in value.

Wider Risk Aversion Appetite

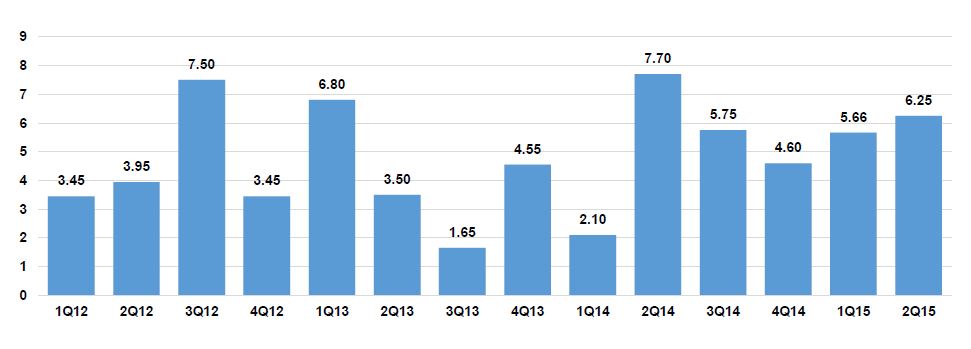

Major issuers for sukuk namely, GCC and Malaysia (with shares of 37.7% and 42.3% respectively) are more dependent on oil sector, but oil prices move in opposite directions with Sukuk Index

since July 2015 (refer COTW). The correlation coefficient dropped as low as -0.51 seen on 4-Aug, and it may suggest investors are willing to take more risk despite persistent low oil prices, in our opinion.

Fitch Revised Outlook on Saudi Arabia

Fitch Ratings reaffirmed sovereign ratings of AA and revised outlook on Saudi Arabia from stable to negative, given continued deficits in fiscal and external buffers; absence of effective fiscal policy response; and geopolitical tensions.

Saudi Arabia has large reserve assets (June-15: USD672.11bn) and low debt-to-GDP ratio (2014: 1.6%) which would allow to weather the prolonged period of low oil prices in the near future. However, the developments in oil prices will continue to make significant shift to the economy (which constitute 90% of fiscal revenues; 80% of current account revenues; 40% of GDP) and would have negative impact on Saudi Arabia if this were accompanied by deterioration on the buffers. Yields for ISDB and SECO were mixed -4bps to 14bps WoW.