Market Performance of Rasmala Global Sukuk Fund for August 2015

Article Overview

August was a challenging month for both GCC equity and fixed income markets as growing concern over slower economic growth in China, lower for longer oil prices, uncertainty surrounding the timing of a US interest rate rise and thin market conditions, resulted in a sharp spike in market volatility. Nervous investors started to panic and finally capitulated when China’s central bank devalued the Renminbi with the action viewed as a clear sign that the Chinese economy is in dire straits. The move by China rippled across emerging FX markets and wiped trillions of US dollars off the valuation of global equity markets on “Black Monday”.

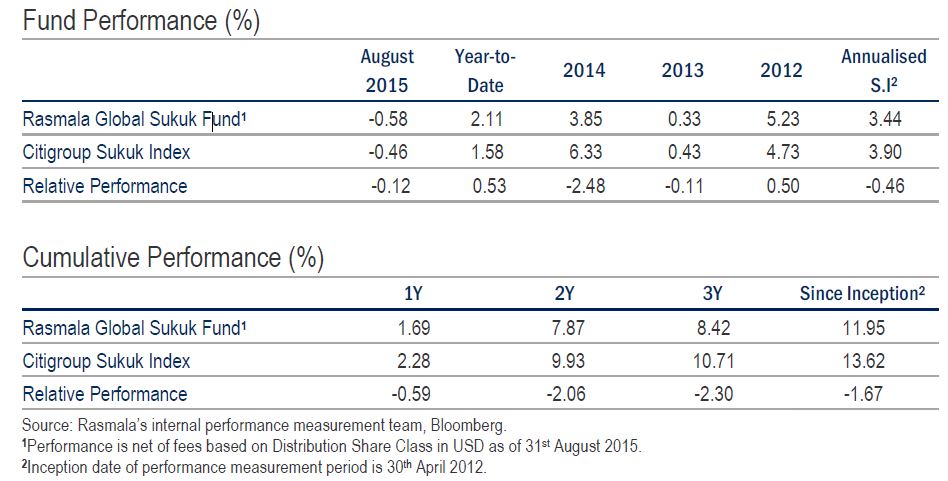

The Fund’s soft absolute and relative August performance was primarily due to the underperformance of emerging market holdings (Turkey and Indonesia) as well as longer duration exposure to SECO which we continue to hold due to the steepness of the credit curve. The Fund’s weighted average duration remains broadly unchanged at 3.49 years (July 3.38 years) versus the benchmark of 4.55 years. The weighted average yield to maturity increased to 3.92% (July 3.52%) primarily due to the lower cash levels and higher sukuk yields while the average credit rating remained unchanged at Baa2.

Market Outlook

September will be crucial as markets digest the outcome of the Fed meeting on the 17th September which was earmarked by many as the beginning of a US rate rise cycle following a period of steady US economic data. This bullish view should be juxtaposed against slowing global growth, tightening financial conditions, heightened market volatility and little evidence of inflationary pressure. Despite Yellen’s dovish tone at the press conference which followed the Fed rates announcement, there remains a willingness within the Fed to normalize the US interest rate environment once market volatility subsides and there is clarity with respect to the trajectory of the Chinese economy.

Download Full Report

Rasmala Global Sukuk Fund Aug 2015 Report

Fund Information

The Luxembourg domiciled, UCITS compliant, Rasmala Global Sukuk Fund (“Fund”) invests in a portfolio of Sharia’a compliant assets comprised primarily of investment grade government, government related and corporate sukuk diversified by geography, sector and issuer. The Fund is dynamically managed and targets both income and capital appreciation. The Fund expects to distribute semi-annual dividends around the 30th June and 31st December.

Fund Size USD 39.61 million

ISIN Number LU1039506784

Management Fee 0.85%