Malaysia Based Islamic Finance Body Issues Sukuk

Article Overview

Short term Sukuk rated A-1 by Standard and Poor’s Rating Services (S&P’s) have been issued by the International Islamic Liquidity Management (IILM) as its issuance borrowing costs increase slightly.

IILM issued two sukuk, a three month $490 million issuance with a 3 month maturity was sold at a profit rate of 0.633%, and a longer six month issuance for $500 million was sold at a profit rate of 0.929%. As a comparison a July three month issuance for $860 million was sold at a profit rate of 0.58325%.

The IILM is an international institution established by central banks, monetary agencies and multilateral organisations to introduce and facilitate effective cross-border Shari’ah-compliant liquidity management.

IILM sells its Sukuk through its primary dealers, who consist of: Abu Dhabi Islamic Bank, AlBaraka Turk, CIMB Islamic Bank Bhd, Kuwait Finance House, Maybank Islamic Bhd, National Bank of Abu Dhabi, Qatar National Bank, Standard Chartered Bank and Barwa Bank.

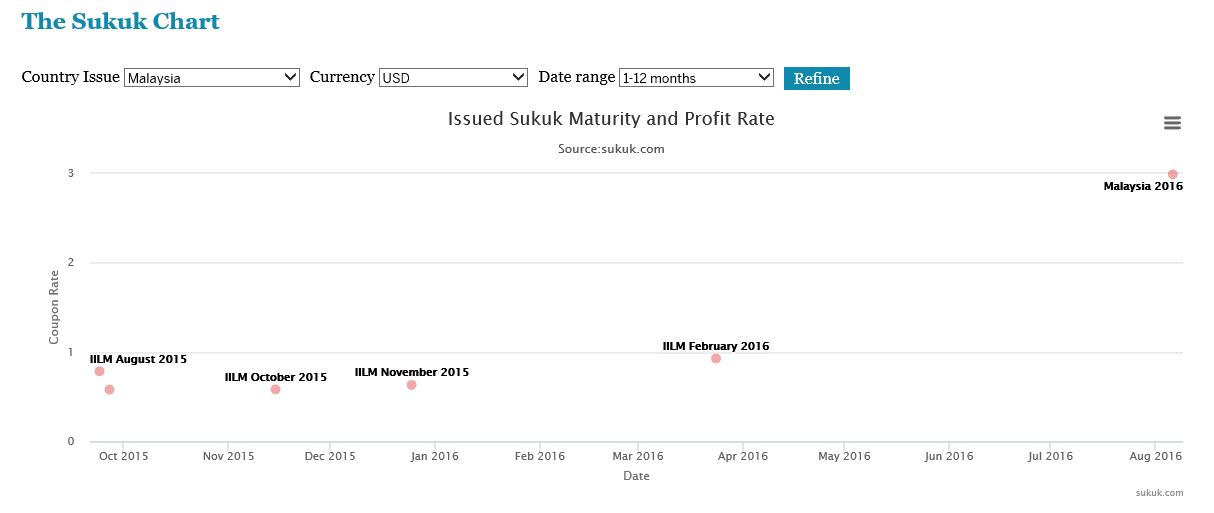

View Sukuk Issuance Profit Rates

Issued profit rates can be viewed and compared using The Sukuk Chart available on Sukuk.com and IslamicFinance.com.