Islamic Asset Management looks to Evolve in Switzerland

Article Overview

Up to $4 trillion of wealth may be looking for a Sharia compliant home according to John Sandwick of Safa Invest, who sees potential in the development of the Islamic Asset Management sector.

In an interview with Dukascopy, Mr Sandwick discussed the opportunity of Islamic Asset Management seeing great potential and describing it as the new frontier for Islamic Banking. He stated the rise in oil prices which began their ascent in 2002 from $9 to $150 per barrel also witnessed a parallel growth in Islamic Banking, as the oil producing economies of the Gulf and South East Asia benefited from large inflows of capital some of which helped fund an emerging Islamic banking market. One sector which has failed to evolve as fast is Islamic Asset Management, an area which according to Mr Sandwick, Switzerland with its historical ties to the Asian and Gulf market it is primed to develop.

Size of the Islamic Finance Market

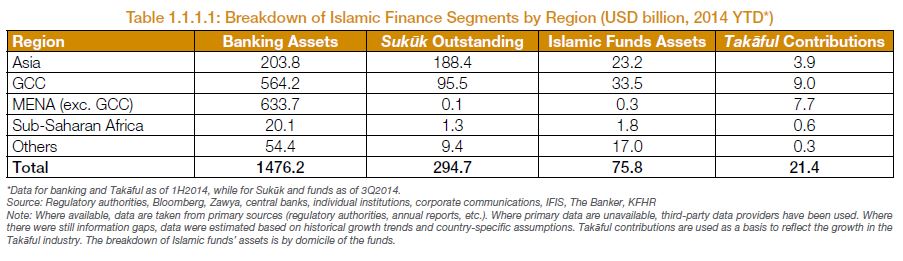

According to the Islamic Financial Services Board (IFSB), Islamic finance assets are heavily concentrated in the Middle East and Asia, although the number of new markets is expanding. The GCC region accounts for the largest proportion of Islamic financial assets as the sector sets to gain mainstream relevance in most of its jurisdictions; the region represents 37.6% of the total global Islamic financial assets (see Table 1.1.1.1). The Middle East and North Africa (MENA) region (excluding GCC) ranks a close second, with a 34.4% share, buoyed by Iran’s fully Sharīʿah compliant banking sector. Asia ranks third, representing a 22.4% share in the global total, largely spearheaded by the Malaysian Islamic finance marketplace.

Watch full interview below.