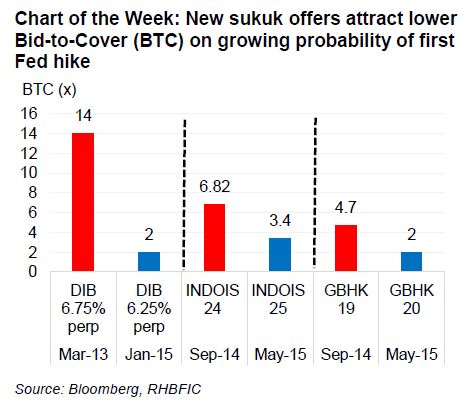

Lower BTC for the new sukuk offers on growing concern on Fed first hike

The new 10y INDOIS 25 4.325% issued this month was oversubscribed 3.4 times (x) vs. 10y INDOIS 24 4.35% was at 6.82x. Another example is the Hong Kong sukuk that was issued this week (5y GBHK 20 1.84%) had a bid-to-cover (BTC) of 2x compared to its inaugural sukuk was oversubscribed at 4.7x. We believe the slower orders could partly be due to some liquidity tightening expectation later this year or in 2016 from lower oil prices and/or US Fed rate hike. We also see a similar trend in GCC issuers, where the issuance of Dubai Islamic Bank (DIB) in January 2015 had a BTC of 2x, compared to its previous Tier 1 sukuk issuance in March 2013 which had a BTC of 14x due to regional conflict concerns earlier in the year. We opine geopolitics, liquidity pressures, low oil prices and rate hike expectations may slow demand in 2015, but will remain within a healthy range.