Indonesia’s Islamic bond market is the second largest in emerging East Asia in terms of size. However, the pace of growth of its sukuk market pales in comparison to the robust growth of its conventional bond market. The Indonesian sukuk market is still in a nascent stage of development and accounts for only 7.4% of the total bond market.

The outstanding stock of Indonesia’s sukuk market reached US$12.3 billion at end-2013, with growth mainly driven by the government sector. While the corporate sector preceded the government sector in terms of sukuk issuance, its growth has not yet really taken off. Government Sukuk accounted for 95.0% of total outstanding sukuk in Indonesia at end-2013, with most of the issuance coming from the sale of Islamic treasury bills and bonds, and global sovereign sukuk.

At end-2013, LCY-denominated sukuk accounted for 66.3% of the total sukuk and FCY-denominated Sukuk accounted for the remaining 33.7%. To date, all FCY denominated sukuk in Indonesia has been issued by the government.

The Government of Indonesia commenced issuance of Islamic bonds in 2008 after the State Shari’ah Securities bill was passed into law in May 2008. This regulation allowed the government to issue Islamic securities and provided a new source of funding for financing the government’s budget deficit. Treasury sukuk are commonly called Surat Berharga Syariah Negara (SBSN).

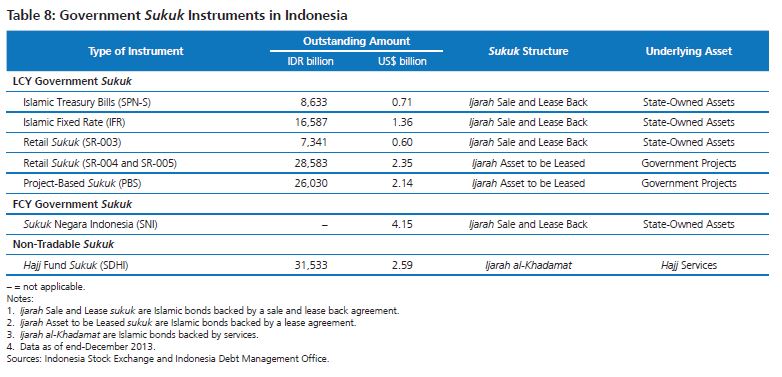

The Indonesian government issued its first sovereign sukuk based on the ijarah principle in August 2008 with the sale of 7-year (IFR0001) and 10-year (IFR0002) Islamic bonds. Subsequently, the government issued its first retail sukuk in February 2009 with a 3-year tenor and its first global sukuk in April of the same year. The government issued its first Islamic treasury bills with a 6-month tenor in 2011 and its first project-based sukuk in 2012. Table 8 presents the various type of sukuk issued by the Indonesian central government that remained outstanding as of end-2013.

The Indonesian government issues sukuk through a special purpose vehicle, Perusahaan Penerbit SBSN (PP SBSN), which acts as both the issuer and trustee. PP SBSN is wholly owned by the government but operates as a separate entity. It acts as the issuer of sukuk on behalf of the government, while the government serves as the obligor to the issue and is responsible for the payment of the coupon and the principal of the sukuk at maturity.

Through PP SBSN, the government has issued Sukuk structured on the ijarah principle, with the sukuk backed by state-owned assets such as land and buildings. Sukuk issued under this structure are treasury bills and bonds, retail bonds, and sovereign US$-denominated bonds.

In 2011, two scheduled domestic sukuk auctions were cancelled as the government had to wait for the approval of the underlying assets to back the issuance of sukuk.

In addition, PP SBSN has also issued sukuk under the structure of ijarah, with government infrastructure projects as the underlying asset to be leased. Sukuk issued under this structure include project-based sukuk (PBS) and some series of retail bonds. The issuance of PBS has become part of the government’s sukuk auction since 2012. PP SBSN has also issued sukuk backed by funds for Hajj-related services under the structure of ijarah al khadamat. These sukuk, however, are issued through private placement and form part of the non-tradable stock of sukuk.

In 2012, the government began conducting regular auctions of Islamic treasury instruments. Sukuk auctions are currently conducted twice a month, alternately with the auction of conventional bonds. Unlike government auctions for conventional bonds where the government accepts bids in line with or even above its target, most sukuk auctions result with the government either rejecting all bids or accepting bids below its target amount.

Demand for sukuk is quite strong as evidenced by the volume of bids during auctions. However, investors demand higher yields than the government is willing to accept. Furthermore, the trading of sukuk instruments are quite illiquid in Indonesia as most buyers tend to buy and hold.

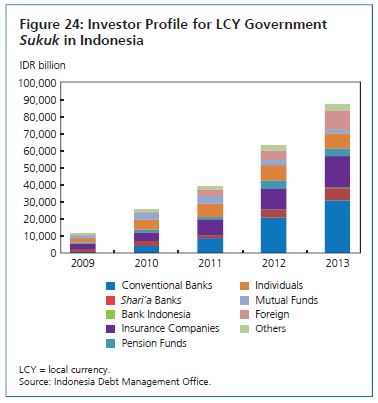

At end-2013, conventional banks were the largest holders of shari’ah-compliant treasury instruments in Indonesia (Figure 24). Their share of sukuk holdings steadily rose from only 3.7% of the total at end-2009 to 35.4% at end-2013. Shari’ah banks, on the other hand, only accounted for an 8.2% share of the total at end-2013. Insurance companies were the second largest holder of sukuk at end-2013 with a 21.1% share, while foreign investors held a 12.6% share of the total. To further develop the sukuk market and reduce reliance on foreign investors, the government is looking into using Hajj funds to buy more government sukuk.

Bank Indonesia also issues shari’ah-compliant central bank certificates, more commonly known as Sertifikat Bank Indonesia Shari’ah (SBIS). SBIS are shari’ah–compliant short-term instruments used by Bank Indonesia as one of its monetary tools to contain inflation and manage liquidity in the financial system. Prior to 2008, SBIS were structured under the wadi’ah (arrangement that is based on custodianship of an asset) principle.

At present, SBIS are based on the ju’alah (arrangement that is based on service charges) principle. At end-2013, the outstanding stock of SBIS reached US$0.4 billion, representing a small 3.1% share of the total sukuk market in Indonesia. Auctions of SBIS are held once a month together with the auction of conventional SBI. SBIS carry a maturity of 9 months and require a holding period of 1 month.

The first sukuk issuance in Indonesia came from the corporate sector in 2002. Telecommunications firm Indosat issued IDR175 billion of 5-year sukuk based on a mudarabah contract. In 2004, the first sukuk ijarah were issued by an Indonesian retail company, Matahari Putra Prima, through an IDR150 billion 5-year Islamic bond.

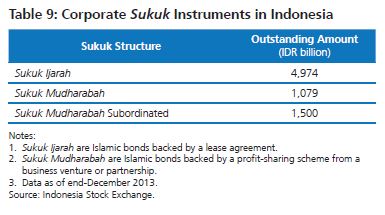

Despite the headway made in issuing sukuk, the size of Indonesia’s corporate sukuk market is relatively small compared with the government sector. Outstanding corporate sukuk reached US$0.6 billion at end-2013. To date, all corporate sukuk in Indonesia have been issued in LCY. Table 9 presents corporate sukuk outstanding at end-2013 by type.

Corporate sukuk in Indonesia are structured following the principles of ijarah and mudharabah, as approved in fatwas issued by the National Sharia’ah Board. At end-2013, corporate sukuk based on an ijarah contract accounted for 65.9% of total corporate sukuk outstanding.

Issuance of corporate sukuk is concentrated among a few corporate names. At end-2013, there were 36 outstanding sukuk series issued by 17 corporate entities. The top three sukuk issuers accounted for 60% of total outstanding corporate sukuk (Table 10), led by state-owned power firm PLN with sukuk outstanding totaling IDR2,140 billion. (PLN is also Indonesia’s top corporate issuer of conventional bonds.) Bank Muamalat was in the second spot with IDR1,500 billion of sukuk, followed by telecommunications firm Indosat with IDR900 billion.

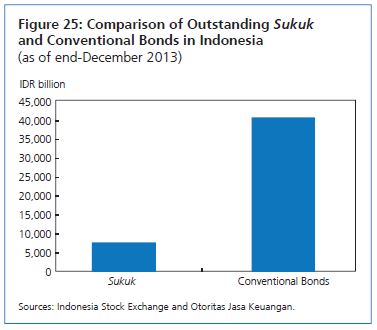

All corporate issuers of sukuk at end-2013 were also issuers of conventional bonds except for Bank Muamalat, which is an Islamic bank. However, the amounts of their outstanding conventional bonds are much larger than their amounts of outstanding corporate sukuk. Figure 25 shows a comparison of the size of outstanding sukuk and conventional bonds issued by the 16 Indonesian firms in our list of corporate sukuk issuers.

Corporate sukuk issuers come from a diverse set of businesses, with two major sectors dominating the list. At end-2013, nearly half of total corporate Sukuk outstanding were issued by firms from infrastructure, utilities, and telecommunications industries (Figure 26).

Finance-related companies accounted for about 30% of corporate sukuk. Other corporate issuers—including firms with business interests in real estate, consumer goods, and agriculture—had a share of 7% or less.

Most corporate sukuk in Indonesia carry medium-term (5-year) maturities. The longest-dated corporate Sukuk was issued by PLN and carried a maturity of 12 years. The average issue size of an Indonesian corporate Sukuk is about IDR210 billion or only about one-third of the average issue size of conventional bonds.

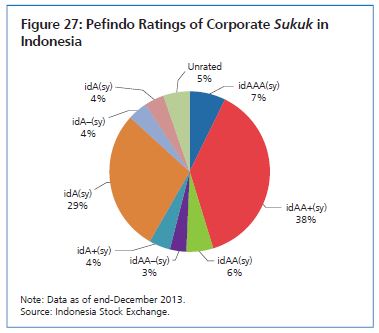

At end-2013, corporate sukuk rated idAAA (sy), by Pefindo, accounted for 7% of outstanding corporate sukuk. All of these sukuk were issued by PLN, a state-owned energy firm. Most corporate sukuk are rated idAA+(sy) and idA (sy), with shares of 38% and 29%, respectively, at end-2013. Figure 27 shows the distribution of ratings for sukuk.

Source: Asia Bond Monitor, March 2014, Page 31 – 35. Asian Development Bank

Asia-Bond-Monitor-March-2014 – Asian Development Bank ![]()