The global Islamic fund sector amassed USD75.8bln in assets under management (AuM) as of 17 September 2014, with 1,161 active funds. The market is led by Saudi Arabia and Malaysia, which together hold 65% of Shariah-compliant AuM.

European jurisdictions continue to attract fund managers with Islamic offerings. In Asia, a substantial more funds are emerging from Indonesia and Pakistan.

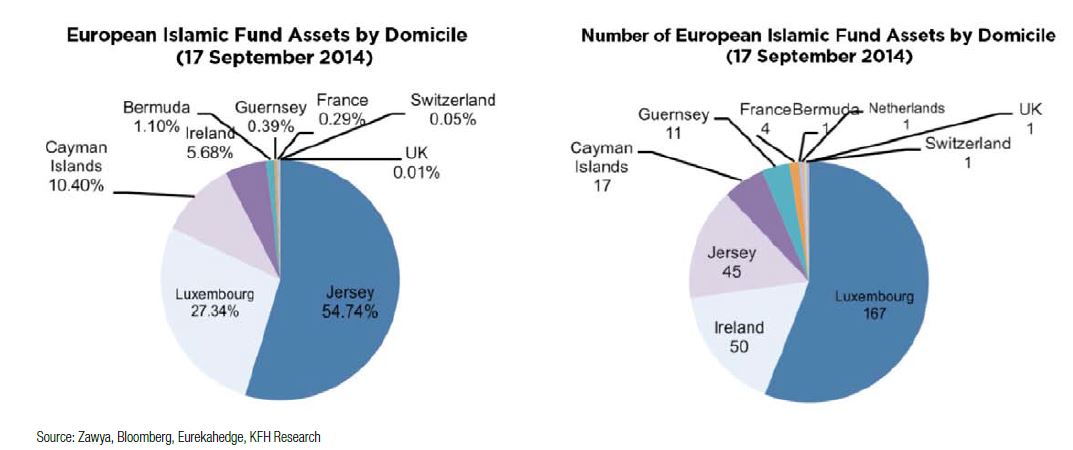

Islamic funds domiciled in Europe held approximately 11.9bln USD in assets under management (AuM) as at 17 September 2014, accounting for sizeable 16.3% of the global aggregate Shariah-compliant AuM, up from an 11.8% share as at end-2012. Apart from the offshore centre in Jersey, other key European players in the Islamic funds market are located in Luxembourg and Ireland. These funds invest mainly in global markets, as well as the Middle East and North Africa (MENA) region.