In the US, the Islamic finance sector has traditionally been involved in financing transactions at the consumer level. The first, and most notable, systematic attempt to bring Islamic finance to the US retail consumer market was made in the mid-1990s when the Office of the Comptroller of the Currency (OCC) formally recognised the ijarah and the murabahah models as being valid for transactions involving residential property purchases.

There are presently a few IIFSs in the US that are able to ensure the proper supervision of the Shari’ah advisers required by the national market, and which have established close partnerships with regulators and key financial institutions. These firms are bringing Shari’ah-compliant products into the US, and Islamic finance is quickly being recognised by mainstream financial institutions as offering a strong, niche consumer market.

The year 1999 saw the launch of the Dow Jones Islamic Market Index created for investors seeking equity investments in compliance with the unique principles of the Shari’ah. Consequently, this index combines Islamic investment principles with the transparency and rules-based methodology of the traditional Dow Jones Index. It covers thousands of blue chips, fixed income investments and indices arranged along thematic lines. Companies must meet certain requirements related to the acceptability of their products, business activities, debt levels, interest income and expenditure in order to qualify for inclusion in the indices.

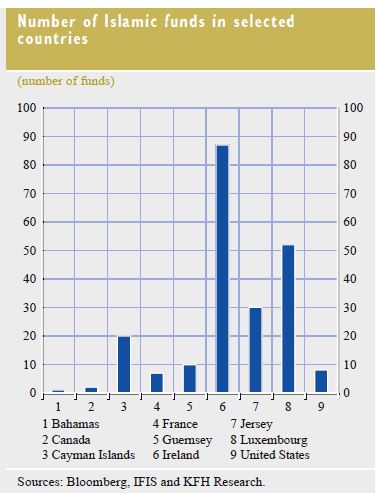

The interest and involvement of US-based entities in Islamic finance has grown continuously over the past 30 years. To date, seven Islamic funds have been launched with total assets under management of USD 3.6 billion, which represents 7.9% of all Islamic funds managed around the globe. There are about 15 financial institutions that operate on an “usury-free” basis, offering a wide range of Shari’ah-compliant products and services, including home financing, personal financing, mutual funds, business financing and investment services. Moreover, five ifferent issuers have tapped the sukuk market in various jurisdictions, issuing sukuk worth USD 1.1 billion, of which USD 500 million by GE Capital.

Islamic finance has grown differently in the US than in other parts of the world, being largely driven by domestic demand. Home financing products account for most of this demand, with around 10,000 Shari’ah-compliant home purchases having been concluded over the past decade. So far, in the US, Islamic financial institutions have avoided deposit-taking operations due to the regulatory hurdles involved. The relevant regulation on banking is currently similar for all banks wanting to operate in the US, i.e. for both conventional and Islamic banks. In some cases, however, US regulators have raised the concern that banks offering Islamic financial products like murabahah may be violating rules prohibiting them from owning real estate other than their own buildings and “other real estate owned” (OREO; mostly foreclosed properties that must be sold within five years).

Hence, many Islamic institutions have opted to operate as leasing companies or mortgage brokers, as these are subject to far fewer restrictions. Overall, the US Islamic finance industry remains a niche segment in the wider North American financial sector.

BALJEET KAUR GREWAL

European Central Bank