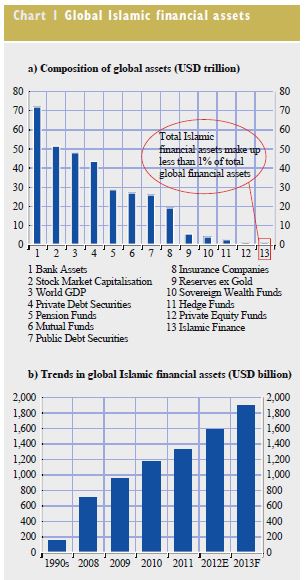

According to data published by Al Rayan Bank, as end of 2014 Islamic assets represented about 1% of the global financial market.

The Muslim population of the world is estimated at about 1.5 billion, representing 24% of total world population of 6.3 billion, however it would be too simplistic to suggest all Muslims desire to bank based on Islamic principles as evidence suggests most Muslims do not have a problem with the use of interest (whose absence is one of the key pillars of Islamic Banking) and therefore continue to use conventional banks.

The global market for Islamic financial services, as measured by Sharia compliant assets, is estimated by the UK Islamic Finance Secretariat (UKIFS) to have reached $1,460bn at end-2012. This represents a 222.5% increase since 2006, when assets totalled £462bn.

The Islamic financial market runs parallel to the conventional financial market and provides investors with an alternative investment philosophy that is rapidly gaining acceptance. The fact that the Islamic financial market does not prohibit participation from non-Muslims creates unlimited upside to the depth and breadth of this market.

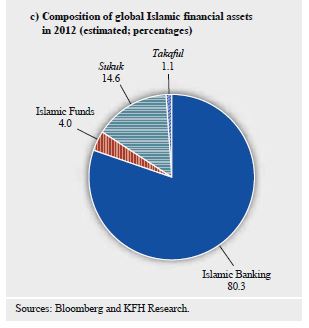

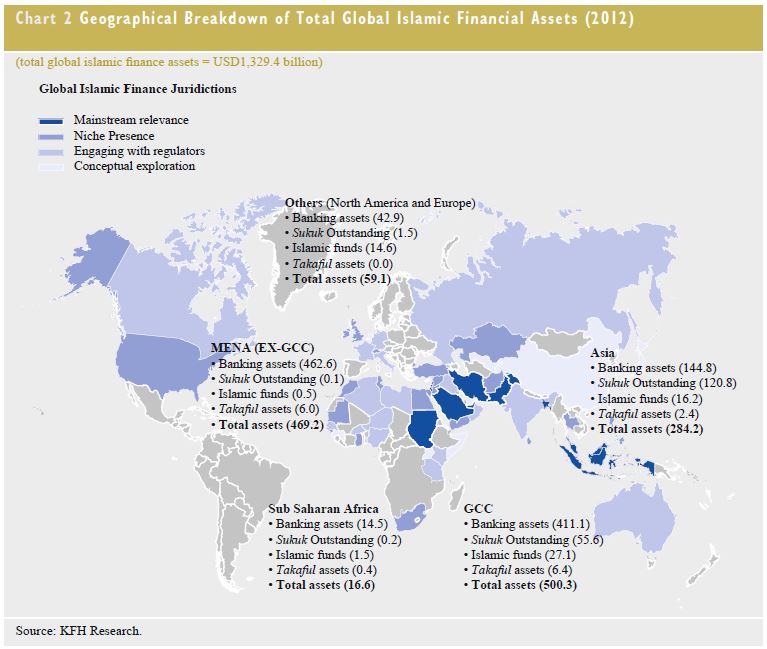

Islamic finance has developed significantly over the years to become a noticeable part of the international financial system (see Chart 1a). The value of Islamic financial assets worldwide increased from USD 150 billion in the mid-1990s to about USD 1.6 trillion by end-2012, led by the Islamic banking sector and the global sukuk market (see charts 1b and 1c).

In 2013, it is estimated to have reached the high figure of USD 1.9 trillion. Despite the formidable growth of the last few years, Islamic finance still accounts for a relatively small share of global finance, and remains mostly localised in selected areas of the world, particularly in the Middle East and Far Eastern Asia (see Chart 1).

The growth of the Islamic finance industry has mainly been driven by the following factors:

- abundant liquidity flows from the recycling of petro-dollars generated by high oil prices over the years;

- the active role played by some jurisdictions around the world to promote the development of Islamic financial markets in their respective countries;

- a growing Muslim population and the related higher demand for Shari’ah-compliant products;

- an increased perception that Islamic finance can support efforts to promote global financial stability;

- the fact that multilateral organisations (e.g. the IMF) as well as a number of central banks have embarked on extensive studies/ research initiatives to examine prospects for Islamic fi nance within their respective economic blocs/regions.

Baljeet Kaur Grewal, European Central Bank

Al Rayan Bank, UK