Since 1990, the Islamic capital market has developed rapidly across the globe, from South-East Asia to the GCC region and to Europe, becoming a truly international market for fundraising activities. This strong growth has been driven by the increase in the earnings of oil exporting countries resulting from a rise in global oil prices. Participating institutions include multilateral organisations, such as the World Bank and the Islamic Development Bank (IDB), as well as both Islamic and conventional corporate entities.

The Islamic capital market is an integral part of the Islamic financial system. It enables the efficient mobilisation of resources and an optimal allocation thereof, thereby complementing the financial intermediary role of Islamic institutions in the investment process (see Aziz 2012b). Although this market functions similarly to the conventional capital market, any financial arrangement it facilitates has to be in line with the Shari’ah principles summarised earlier. At present, Islamic equity, Islamic bonds (sukuk), Islamic funds and Islamic real estate investment trusts (REITs) are offered as alternatives to conventional instruments.

Sukuk (see Section 1.4) have been a particularly fast growing segment of the market and, after Islamic banking, represent the second-largest asset class within the Islamic finance industry.

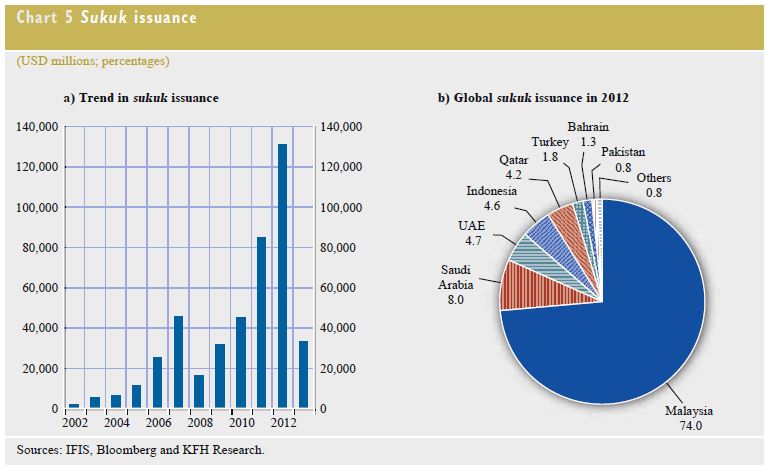

The sukuk has become an important vehicle for international fundraising and investment activities that generate significant cross-border flows. As at end-2012, the value of outstanding global sukuk topped USD 229.4 billion – a record high helped by new issuances worth USD 131.2 billion (see Chart 5a). Malaysia, Qatar, the UAE, Saudi Arabia and Indonesia feature among the countries that have been at the forefront of growth in the sukuk primary market (see Chart 5b).

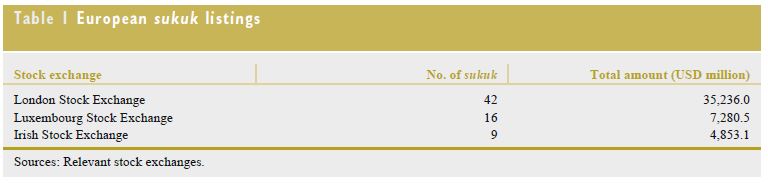

At present, there are four major sukuk-listing domiciles, namely the London Stock Exchange, the Bursa Malaysia (in Kuala Lumpur), NASDAQ Dubai and the Luxembourg Stock Exchange. The London Stock Exchange is the largest exchange for sukuk listings: this offers the benefit of competitive admission and listing costs, being the only major listing venue that does not charge an annual fee to the issuer. During 2012, the exchange attracted two further sukuk issuances, bringing the total number of its sukuk listings to 42 and the total amount of capital raised to over USD 35.2 billion (see Table 1).

Until a few years ago, the demand for sukuk was limited outside of Asia and the GCC region. The new issuances made in 2012 were dominated by government institutions, as well as the construction and financial services industries. Having benefited from a compound annual growth rate of 57% over the past decade, the value of outstanding global sukuk reached an estimated USD 225 billion at the end of 2012.

As regards Islamic investment funds, in 2011, the latest year for which data is available, the size of assets under management stood at USD 60 billion, with the number of funds rising to 876 during this year and accounting for approximately 4.6% of global Islamic financial assets. In terms of fund domicile, Saudi Arabia remains the key market for Islamic investors. This country accounted for 42.4% of the industry in 2011, followed by Malaysia at 25.9%, the United States (US) at 7.9%, Kuwait at 4.9% and Ireland at 4.1%.

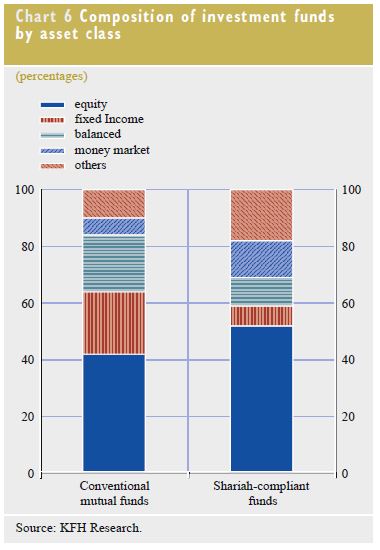

While conventional investment funds show a more balanced asset allocation and an orientation towards fixed income assets, Shari’ah-compliant funds are focused on equities and money market instruments (see Chart 6).

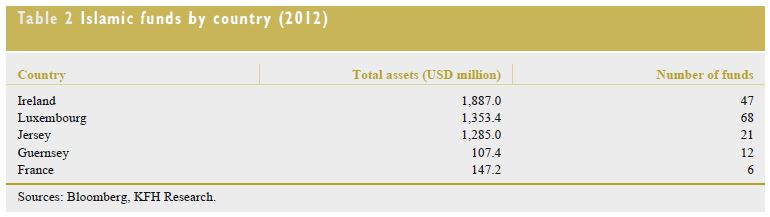

European Islamic funds currently represent 8.3% of the global Islamic fund industry, with Ireland and Luxembourg accounting for 7% alone. In its endeavour to project Dublin as the European hub for Islamic funds, the Irish government has taken the initiative to educate prospective managers on the benefits of having an Irish domicile for their funds. Ireland’s popularity as a domicile for Islamic funds is based on the wealth of expertise across all service channels available, including talented human capital and established financial regulation. In 2012, there were 47 Islamic funds domiciled in Ireland with total assets worth USD 1.9 billion (see Table 2).

Prospects for the Islamic funds industry are expected to continue to improve, supported by sustained economic growth, particularly with regard to oil and commodity-producing economies. Countries with a high savings rate and a surplus are also likely to drive demand for Shari’ah-compliant investments. It is estimated that the assets under management of the Islamic funds industry reached USD 63.2 billion by the end of 2012.

BALJEET KAUR GREWAL

European Central Bank