Report by Malaysia International Islamic Financial Centre

Islamic Funds: Gearing Up

Article Overview

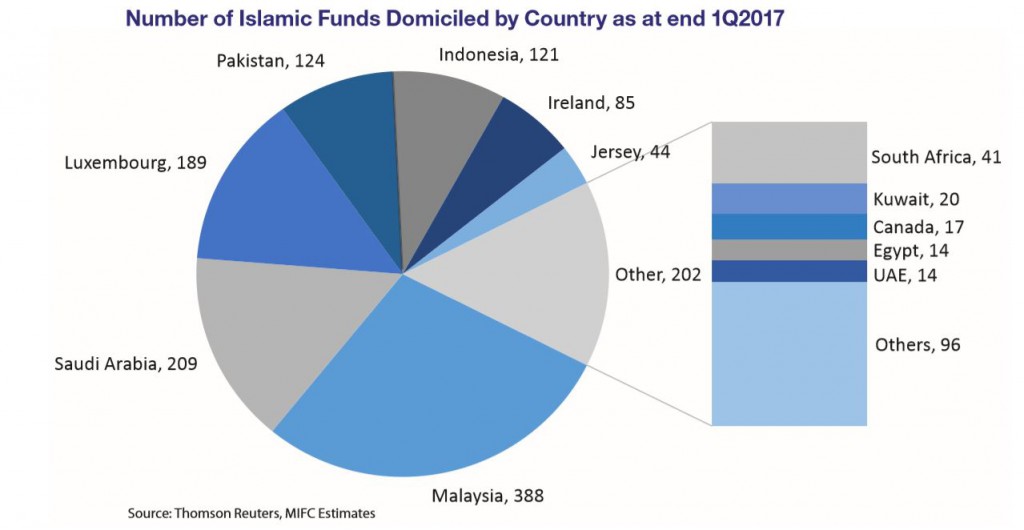

The global Islamic funds industry is poised for growth witnessing greater demand for Shariah-compliant investment, supported by increasing range of Islamic financial assets available in the market. As at end 1Q2017, the total global Islamic assets under management (AuM) were USD70.8 billion and the number of Islamic funds stood at 1,535. There were only 802 funds with AuM of USD47 billion in 2008.

The global Islamic fund and wealth management sector is on the rise, a natural outcome of the growing demand for Shariah-compliant investment supported by increasing range of Islamic financial assets available in the market. As at end 1Q2017, the total global Islamic assets under management (AuM) were USD70.8 billion and the number of Islamic funds stood at 1,5351. There were only 802 funds with AuM of USD47 billion in 2008.

The industry now forms as part of the emerging development in the wealth and management industry, a result of the growing interest from large and established fund managers tapping into this window of opportunities. This sector continued to experience growth and poised for rapid evolution spinning off from just catering for affluent investors who wish to invest surplus funds in a Shariahcompliant manner. Islamic investment opportunities are now accessible to institutional investors as well as non-Muslim investors to diversify their investments through Shariah-compliant funds. Eyeing on the broader prospects, globally, high net worth individuals (HNWI) wealth is projected to nearly triple in size from 2006-2025 to surpass USD100 trillion by 2025, propelled by strong AsiaPacific growth2. It is reported HNWIs hold less than one third of their global wealth with wealth managers, underscoring the potentials to amass HNWIs total investable wealth.