Despite slowdown, in USD terms size of market little changed

Article Overview

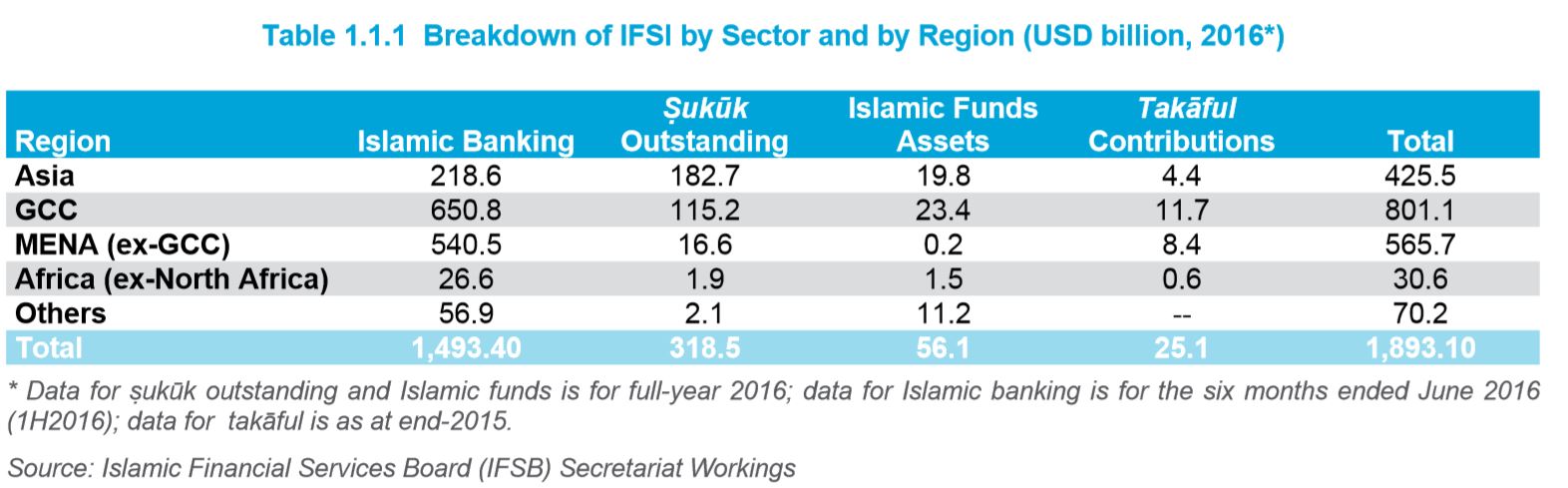

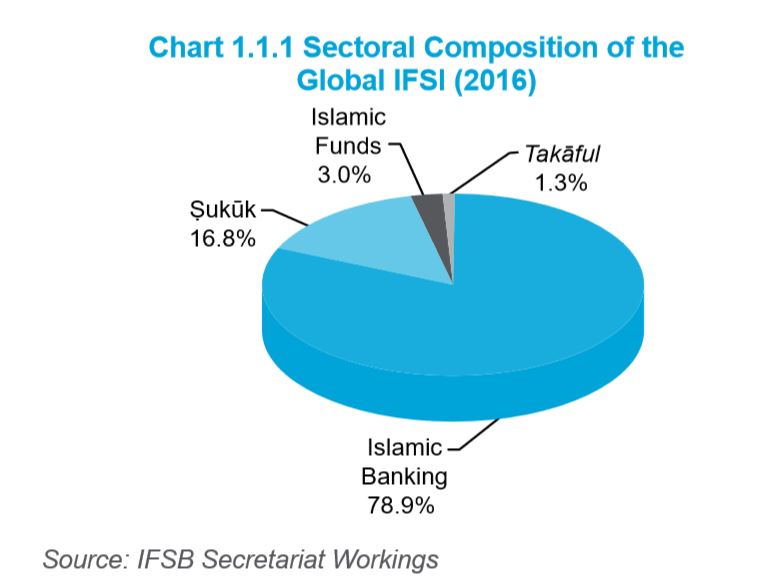

The Islamic Financial Services Board (IFSB) in its annual Islamic financial services industry stability report highlighted continued slowdown of the global Islamic Financial Services Industry (IFSI). Despite this, the global IFSI has been able to sustain its total assets value at approximately USD1.9 trillion in 2016.

2016 – Another year of slowdown for IFSI

2016 has been another year of slowdown for the global Islamic Financial Services Industry (IFSI) – in USD terms, the size of the IFSI has not changed much over the last year: The total Islamic banking assets increased from USD 1.4 trillion to USD 1.5 trillion, the volume of ṣukūk outstanding increased (USD 318.5 billion), but Islamic funds’ assets decreased (USD 56 billion); takāful contributions increased slightly (USD 25 billion).

Size and Resilience of the IFSI

Islamic Banking

The development in Islamic banking was more dynamic than the stagnant total assets suggest: The regional composition of the global assets has changed. The assets of MENA excluding GCC – i.e. predominantly Iran – dropped from USD 607 billion to USD 541 billion due to a strong depreciation of the Iranian currency. This was compensated by asset growth in the GCC and Asia (despite currency depreciations). The share in total Islamic financial assets of MENA excluding GCC decreased to 30%, the GCC increased to 42%, and Asia remained at 22%. The majority of jurisdictions where IIFS operate, recorded reasonable levels of growth in assets, financing and deposits of Islamic banks. More importantly, Islamic banks’ market shares increased in 18 and remained constant or decreased only marginally in 13 jurisdictions. This is a strong indication of a growing acceptance of Islamic finance in jurisdictions with dual financial systems. The number of jurisdictions where Islamic finance has achieved domestic systemic importance has expanded to 12.

Islamic Capital Market

In summary, the ICM performed better in 2016 than in 2015: Ṣukūk issuances increased and Islamic stocks generated profits. However, there were also some setbacks: 2016 saw the first default of a ṣukūk in 6 years (issued by an oil and gas-based company in Singapore). Expected ṣukūk issuances in non-OIC jurisdictions did not materialise. In contrast to previous years, Sharīʻah-compliant equities generated lower returns than conventional equities. The number of Islamic funds has decreased slightly and nearly 30% of the funds have become inactive.

Sukuk

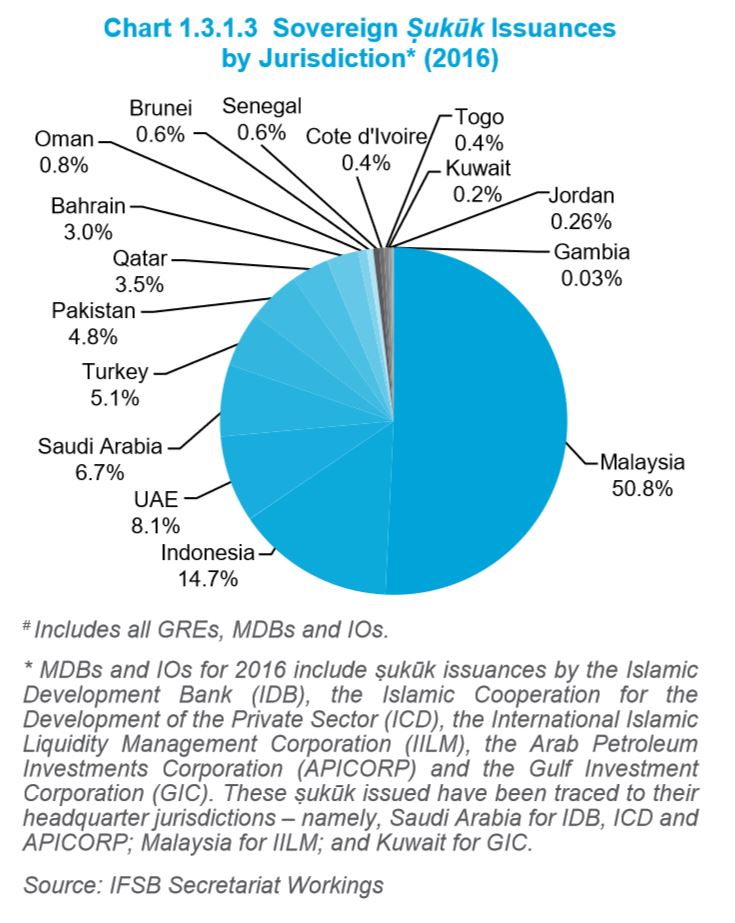

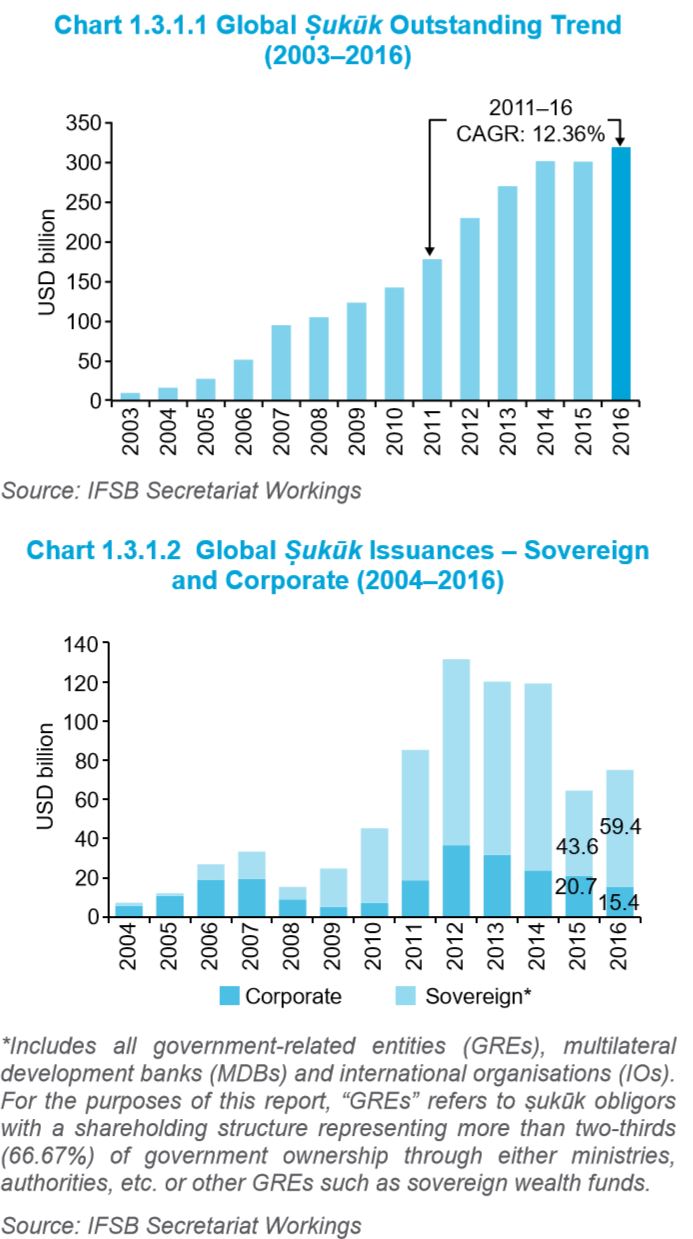

The volume of annual ṣukūk issuances reached USD 75 billion in 2016, bringing the volume of outstanding ṣukūk close to USD 320 billion. 79% of the issuances originated from sovereigns, including GREs and multilateral organisations (such as IDB and IILM); only 21% were corporate issuances.

The corporate ṣukūk market has continued its downward trend for the fourth consecutive year. This may be partially due to socio-political and macroeconomic challenges, but there is also a widespread sentiment that issuing ṣukūk is (still) too complex, time consuming and costly.

Sharīʿah-compliant Equities

Since Sharīʻah-compliant stocks are a subgroup of all listed stocks, it is not surprising that price movements of Islamic and conventional equities are correlated, but their performance can differ. For a decade, Islamic equity indices had outperformed conventional indices. This changed in 2016. Islamic indices attach a greater weight to healthcare and consumer goods/ services which lagged in performance while conventional indices include more financials, utilities and telecommunications, which had a better performance, particularly towards the end of 2016.

Islamic Funds

The equity markets suffered in 2015 and during most of 2016 from volatility-inducing political uncertainties, slow growth, depressed oil prices and volatile commodity prices. However, the unexpected election outcome in the US triggered a stock market rally in November and December, Islamic equity and fixed income funds benefited from the good performance of the Islamic equity indices and the increased ṣukūk yields. Positive results of Islamic commodity funds are mainly due to an increase of the oil price at the end of the year. Although the returns were positive in 2016, the resilience of Islamic funds cannot be taken for granted as most of them lack scale: 73% of the Islamic funds have less than USD 25 million AuM while the average size of conventional funds is USD 394 million AuM.

Takāful

The global takāful industry recorded a growth in contributions of 12% while conventional insurance premiums only grew by 4%. But despite the high growth rate, takāful is by volume still a small and rather fragmented industry with total contributions of USD 25 billion and 305 takāful and retakāful operators and windows. The GCC accounts for 47% of the contributions and 31% of the takāful operators, followed by MENA excluding GCC (i.e. mainly Iran) with 33% of contributions and 22% of the operators, and Asia with 18% of contributions and 15% of the operators.

Download IFSB Industry Stability 2017 Report

![]() IFSB IFSI Stability Report 2017 (1.35MB)

IFSB IFSI Stability Report 2017 (1.35MB)

About the IFSB

The IFSB is an international standard-setting organisation which was officially inaugurated on 3 November 2002 and started operations on 10 March 2003. The organisation promotes and enhances the soundness and stability of the Islamic financial services industry by issuing global prudential standards and guiding principles for the industry, broadly defined to include banking, capital markets and insurance sectors.