Report by IMF highlights key challenges facing the Islamic Financial Industry. Islamic Banking (IB) has grown rapidly in value and geographical reach, and has become an important and integral part of the financial systems in many countries. Though IB accounts for less than 2 percent of global finance, IBs currently operate in more than 60 countries and the industry has become systemically important in 14 jurisdictions.

Ensuring Financial Stability In Countries With Islamic Banking

Article Overview

- 1 Ensuring Financial Stability In Countries With Islamic Banking

- 1.1 Islamic banking (IB) continues to grow rapidly, in size and complexity, posing a challenge to supervisory authorities and central banks.

- 1.2 The legal environment within which Islamic banks (IBs) operate can be complex and challenging and may have implications for financial stability.

- 1.3 International governance standards apply to IB but need to be customized to take into account IBs’ distinct governance features.

- 1.4 International guidance is needed to address the limited progress that has been achieved in developing resolution and financial safety net frameworks for IB.

- 1.5 Progress has been slow in developing IB’s liquidity management and money markets.

- 1.6 In recent years, hybrid financial products in IB have emerged that replicate aspects of conventional finance in an IB context, raising financial stability concerns.

- 1.7 The Fund has played an important role in promoting financial stability in IB jurisdictions, working closely with IB standard setters, and international organization to shape IB standards and promote best practices.

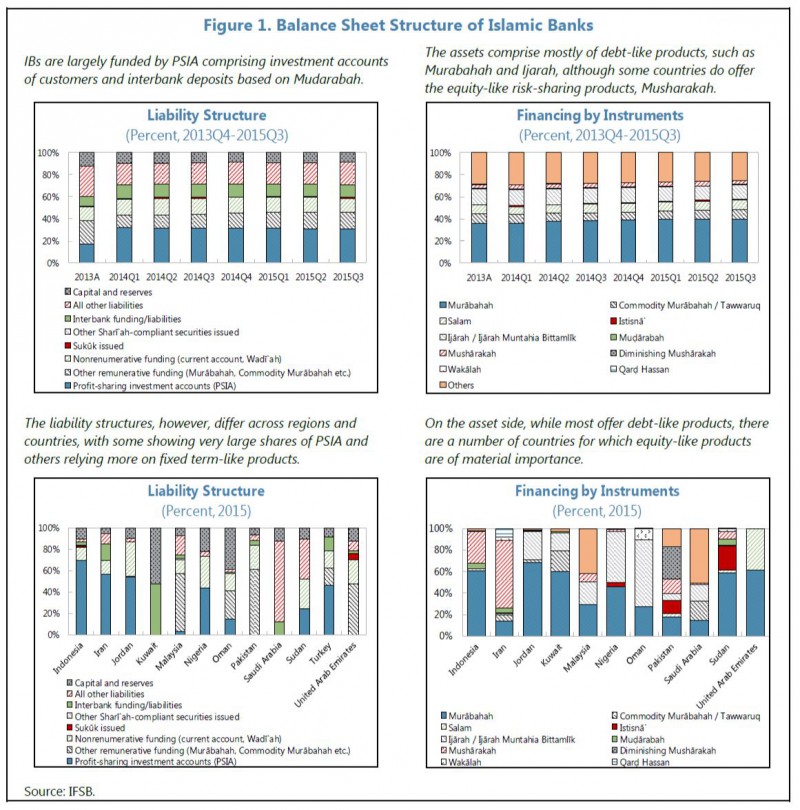

- 1.8 Balance Sheet Structure of Islamic Banks

- 1.9 Download Full Report

While accounting for a small share of global financial assets, IB has established a presence in more than 60 countries and has become systemically important in 14 jurisdictions. Islamic Finance (IF) principles underpin IB and involve operations, balance sheet structures, and risks that differ from their conventional banking counterparts. The current framework governing IB contains many gaps that need to be closed through the development of a more comprehensive enabling environment that ensures IB financial stability and sound development.

The legal environment within which Islamic banks (IBs) operate can be complex and challenging and may have implications for financial stability.

IBs operate in diverse legal environments, some of which are more evolved than others in providing strong legal underpinnings for IB. Legal clarity and certainty for IB are important to promote confidence in the industry, as well as to mitigate the potential risk of regulatory arbitrage and strengthen supervision.

International governance standards apply to IB but need to be customized to take into account IBs’ distinct governance features.

These relate to decision-making structures, Shari’ah compliance, and the rights of investment account holders (IAH). Significant progress has been achieved in developing prudential standards for IB, although broader implementation and more consistent application are needed. Prudential standards for conventional banks generally apply to IB but gaps exist reflecting the specific features of IB and their associated risks. Prudential standards for IB have been developed to complement international standards, including, inter alia, on capital adequacy, “Core Principles of Islamic Finance Regulation for Banking,” and the supervisory process. The adoption of these standards has progressed albeit at different speeds across jurisdictions.

International guidance is needed to address the limited progress that has been achieved in developing resolution and financial safety net frameworks for IB.

The international principles for deposit insurance, lender-of-last-resort (LOLR), and effective bank resolution regimes, are broadly relevant for IB but require modification to address

IB-specific issues. Country practices in this regard, have diverged on several important fronts, including, the insurability of investment accounts, the priority of claims, the role of deposit insurance in resolution, and the adequacy of IB instruments and collateral.

Progress has been slow in developing IB’s liquidity management and money markets.

A dearth of high quality liquid assets (HQLA), including, most importantly, government Sukuk, have undermined IBs’ capacity to manage liquidity, interact with central banks, and develop money markets. This situation has given rise to IB practices that may achieve some liquidity management objectives but are inefficient and present risks. The lack of progress in this area has also impeded efforts to strengthen financial safety nets specific to IBs. International guidance and the active participation by relevant authorities, particularly, in countries where IB is systemically important, are needed to accelerate the issuance of Sukuk and other liquid instruments.

In recent years, hybrid financial products in IB have emerged that replicate aspects of conventional finance in an IB context, raising financial stability concerns.

This trend is spurred by opportunities for profit in a rapidly growing IB sector, coupled with slow progress in developing adequate infrastructure for traditional IB. However, the growth of hybrid products raises a number of concerns, including the emergence of new complex risks, the applicability of existing prudential regimes, governance and consumer protection issues, and reputational risk.

The Fund has played an important role in promoting financial stability in IB jurisdictions, working closely with IB standard setters, and international organization to shape IB standards and promote best practices.

Fund staff are increasingly encountering IB related issues in surveillance, program, and technical assistance (TA) work. A more comprehensive Fund policy framework will help to support the Fund’s work in this area going forward.

Balance Sheet Structure of Islamic Banks

Download Full Report

![]() Ensuring Financial Stability in Countries with Islamic Banking

Ensuring Financial Stability in Countries with Islamic Banking