Recent Issuances

Article Overview

US Dollars Issuances by Dubai Islamic Bank, and the Hong Kong government as well as the Saudi Riyal issuance by Saudi British Bank have been added to the Sukuk.com database.

Additional Commentary by RHB Research ![]()

Bloomberg Sukuk Market Return Index

inched up 0.11% W-o-W (vs. 0.06% in week prior) to 120.03, bringing YTD returns to 1.55% (vs. 1.44% in week prior). Whereas, the Dow Jones Sukuk Total Return Index (DJSUKTXR) declined 0.28% W-o-W (vs. 0.08% in week prior) to 155.62, bringing YTD returns to 2.05% (vs. 1.84% in week prior). Sukuk returns improved from the previous week as Indonesia has successfully priced its 10y USD2bn at 4.325% while Garuda Indonesia, the country’s airline eyeing for USD500m placement of 5y at 6.95%.

In addition to this, weaker US existing home sales (April 2015: -3.3% M-o-M; March 2015: +6.5%), preliminary Markit US manufacturing PMI data (May 2015: 53.8; April 2015: 54.1), US Fed FOMC noting a rate hike in June is highly unlikely had also supported returns. The top five gainers during the week were QATAR 23, KFINKK 19, TUFIKA 19, DEWA 18, and TUFIKA 18, contributing a market value gain of USD1.2bn during the week.

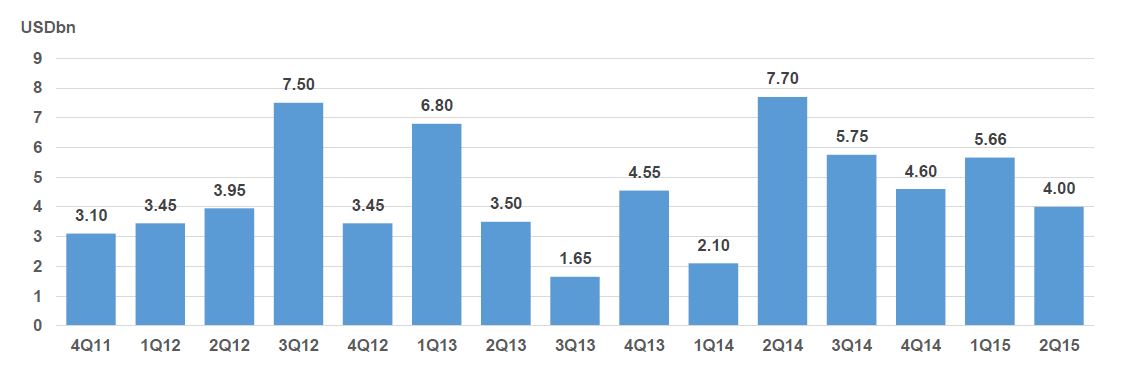

Total issuances reached USD4bn in 2Q15

Sukuk pipeline are likely to add c.USD1bn to USD sukuk primary market. Total issuances reached USD4bn in 2Q15 (by Malaysia Government, Noor Bank and Indonesia) with Garuda and Dubai Islamic Bank could add c.USD1bn to the pipeline, bringing total issuances during the quarter to USD5bn (vs. USD7.6bn in 2Q14). This may mean 1H15 may surpass 1H14 supply (1H14: USD9.8bn; 1H15 YTD: USD9.66bn).

Quarterly USD Sukuk Supply