National Interest Free Banking in Iran, Sudan and Pakistan

Article Overview

An often overlooked area within Islamic finance is the establishment of comprehensive national interest free banking systems in Iran and Sudan as well as to a lesser extent in Pakistan.

Interest free banking is a narrow concept denoting a number of banking instruments or operations, which avoid interest. Islamic finance and banking is the more general term which covers not only the avoidance of interest-based transactions but also the participation in achieving the goals and objectives of an Islamic economy. It is for this reason why estimates of the size of the Islamic finance market tend not to include the entire banking systems of Iran and Sudan as well as part of Pakistan’s.

Iran – The Worlds Only Completely Riba Free Banking System

Iran chose to convert its banking system to an interest free system by the passing of the Law for Usury (Interest)-Free Banking Operations in 1983. [1] The use of law makes the Iranian banking system unique in that all banking activities must follow Sharia principles as a matter of legal requirement as opposed to at a regulatory level.

The switch over to Usury Free Banking was implemented as of 21 March 1984. The law specified that mobilisation of monetary resources by Iranian banks shall be undertaken either through qard al-hash deposits (current and savings) or through term investment deposits. The laws were recently updated as the below video from Iran presents.

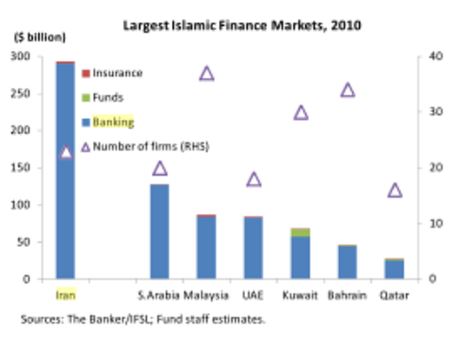

In an IMF publication on the Islamic Republic of Iran, it was stated Iran is the biggest Islamic finance market in the world [2].

Largest Islamic finance markets. Report from IMF.

Sudan – From Complete Riba Free to Dual System

In Sudan, a system of Islamic banking and finance is in operation at national level. Like other Islamic banks around the world the banks in Sudan had been relying in the past on Murabaha financing. However, the share of Musharaka and Mudaraba operations is on increase and presently constitutes about 40 percent of total bank financing.

The original law of 1984 provided for all banking to be Shariah compliant was superseded by separate laws in 1993 which established a Sharia Supervisory Council with the Central Bank, and in 2003 by the Business Banking Act.

Sudan has followed the strictest interpretation of Islamic law on riba and claimed to follow the purest form of Islamic banking. In 2006, after a peace agreement to end the civil war affecting the Southern part of the country, Sudan adopted a dual banking system. [3]

Pakistan – A Decades Old Work in Progress

In contrast to the rapid implementation approach of Iran, Pakistan has taken a gradual approach to convert its banking system to one which is free of interest, and in this regard despite have started in the late 1970s Pakistan’s attempt is still a work in progress.

Steps for the Islamisation of the banking and financial system of Pakistan were started in 1977. Separate Interest-free counters started operating in all the nationalized commercial banks, and one foreign bank (Bank of Oman) on January 1, 1981 to mobilize deposits on profit and loss sharing basis.

Banks were instructed to provide financial accommodation for Government commodity operations on the basis of sale on deferred payment with a mark-up on purchase price. Export bills were to be accommodated on exchange rate differential basis. From July 1, 1982 banks were allowed to provide finance for meeting the working capital needs of trade and industry on a selective basis under the technique of Musharaka.

As from April 1, 1985 all finances to all entities including individuals began to be made in one of the specified interest-free modes. From July 1, 1985, all commercial banking in Pak Rupees was made interest-free. From that date, no bank in Pakistan was allowed to accept any interest-bearing deposits and all existing deposits in a bank were treated to be on the basis of profit and loss sharing. Deposits in current accounts continued to be accepted but no interest or share in profit or loss was allowed to these accounts. However, foreign currency deposits in Pakistan and on-lending of foreign loans continued as before.

Legal Challenges

The procedure adopted by banks in Pakistan since July 1, 1985 was, however, declared un-Islamic by the Federal Shariat Court (FSC) in November 1991. Upon rejecting the appeal, the Shariat Appellate Bench (SAB) of the Supreme Court of Pakistan, in its judgment on December 23, 1999 directed that laws involving interest would cease to have effect finally by June 30, 2001.

Whilst Pakistan has thus far enjoyed limited success in transforming the entire banking system into an interest free system, it has been successful in other aspects of the Islamic economic system such as the state collection of Zakat, in the form of a 2.5% payment from applicable saving accounts within the country.

[1] Islamic Banking by Zubair Iqbal, Abbas Mirakhor

[2] Islamic Republic of Iran: Selected Issues Paper by International Monetary Fund

[3] What Is Wrong with Islamic Economics? by Muhammad Akram Khan

Additional Source: State Bank of Pakistan