A History of Islamic Finance

Article Overview

Despite being seen as a modern phenomenon, Islamic finance is as old as the religion itself with its principles primarily derived from the Quran, which was revealed some 1400 years ago. Some principles of Islamic finance stem from prior Abrahamic traditions, whilst some historical Islamic finance instruments have been adopted into modern conventional products such as letters of credit and cheques.

The Quran and Islamic Economics

Islamic finance products are based on permitted economic and commerce activity as outlined in the Quran within which is revealed permissible sources of income, the prohibiting of other types of income including riba (interest), moral directives in conducting business, unethical trade practises, charity, consumption, wealth accumulation, social responsibility as well as communal development. Islamic finance is simply the products developed based on these requirements.

The Golden Age of Islamic Civilisation

The early Muslims engaged in transactions based on Sharia, and Islamic Economic principles are documented as being practised during the Golden Age of Islamic Civilisation which occurred during the Middle Ages from the mid-7th century to the mid-13th century.

During this era inhabitants established trade routes which stretched from Gibraltar (Jabal Tariq in Arabic) to the Sea of China [1] along which flowed trade based on the principles of Islamic commerce.

Financial innovations in the Islamic world

Shaikh M Ghazanfar in his article Capitalist Traditions in Early Arab-Islamic Civilization states financial innovations during this period led to the development of precursors of today’s financial products which were developed by a need to safeguard the integrity of money transactions. He describes “One such device was the bill of exchange or letter of credit (suftajeh), which became well established in state and private commerce.”

A sakk (the singular to the plural Sukuk) was used as an international cross border cheque, and Ghazanfar further states “One can find precursors of the modern stock-exchange/money market in Islam: there was not only the wholesale/retail commercial exchanges in the funduqs, but also activities typical of the modern commodity exchange”.

It should not be surprising that early developments of financial products in the Islamic world have greatly contributed to modern conventional finance products, as it is consistent with other fields such as science and agriculture, where knowledge was also disseminated and bought back into Europe through trade as well as by the Crusaders.

Trieste Borsa, Stock Exchange in Italy. The Islamic contract Mudarabah was used by Italian merchants who called it “Commenda” a forerunner to todays Limited Company.

Islamic Coinage in Europe

Post-Roman Europe was demonetized and used the trade of furs and lumber with the Islamic Caliphate to get desperately needed hard currency in the form of Islamic coinage. Finds of Islamic coins have been discovered in Europe and illustrate the monetary might of the Muslims. Muslim coinage spread rapidly and dominated the economies of Europe and the Middle East, as well as India. Herman Van Der Wee, an eminent Belgian economic historian, states that the re-monetization of Europe post the Roman Empire and the rebirth of the European banking system owe much to the flow of Muslim coinage to Europe [i].

Ottoman Empire

During the Ottoman Empire (1301-1922) global trade grew, but the development of Islamic finance products was limited [2] though it is believed the first Sukuk was issued in 1775 by the Ottoman Empire when it borrowed money against future income on tobacco customs levies [3] to fund its budget deficit. [4]

Modern Era

See also: The Modern Journey of Development

Barclays Bank Opens Cairo Branch in 1890s for Suez Canal

Barclays Bank opened its Cairo branch during the 1890s to process the financial transactions related to the construction of the Suez Canal. Islamic scholars challenged the operations of the bank, considering its dealings to involve interest. This critique spread to other Arab regions, and to the Indian sub-continent. Majority of Shari’ah scholars declared that interest in all its forms amounts to the prohibited element of riba. [5]

Emergence in India during the 1930s

Modern Islamic economics emerged amongst Indian Muslims in the 1930’s as the country’s Muslim minority feared an independent and Hindu-dominated India would subject them to hostility and discrimination. These worries were based on the build-up of debt by Muslim farmers, mostly to Hindu moneylenders who were prepared to expropriate the lands of defaulters. [6]

Later after a movement to ban usury in Pakistan gained prominence in the 1950s, a push to include a ban on usury in the 1956 constitution did not succeed. As a result a segment of the Muslim population in Pakistan decided to support a Pakistani bank that would lend money without charging interest. This bank did not succeed and soon had to close its doors having run out of deposits and with problems acquiring trained staff.

However, this idea was soon followed by another Islamic bank in Egypt, founded in 1963 by Ahmed El-Nagar. This bank was a success, and eventually led to the founding of the Nasser Social Bank, although it still faced the same problems as the initial bank in Pakistan.

These banks were merged thanks to a grant of $2 million USD from the government of Egypt. The new bank was strict in its adherence to Shariah. All loans were interest free. Loans were given out with a preference for social welfare and projects. Housing for example, had a priority over capital gains or speculation. There were also strict restrictions preventing depositors from re-depositing credit from this bank into conventional banks in search of interest gains. Through various profit sharing ventures and support from its head office in Cairo, this bank was able to participate fully in important community projects.

Critical Mass in Post Colonial Era

Indonesia gained independence in 1945 and Algeria in 1963. In between these two dates, all Muslim majority countries became independent at which point, Islamic finance can be seen as developments in the Gulf, Pakistan and Malaysia and by the late 1970s, the first forays into cross border Islamic Banking.

The following and subsequent videos are extracts from a lecture given by Iqbal Khan at the London School of Economics. Iqbal is a notable and highly distinguished pioneer and modern day practitioner of Islamic finance.

Middle East Growth

The Egyptian Nasser Social Bank was seen as a success by other Muslim countries, which looked to emulate its banking model. Saudi Arabia, in particular, supported the founding of other Islamic banks in Gulf states. Dubai was one of the first countries that responded to this Islamic finance movement and, in 1975, the Dubai Islamic Bank was established. This bank was a modern Islamic bank that was privately owned and operated. It consulted with a committee of religious advisors for all matters of policy.

Next, the Kuwait Finance House was established in 1977 which, unlike the Dubai Islamic Bank, was majorly owned by government ministries. Two additional banks were founded in 1977, the Faisal Islamic Banks of Sudan and the Faisal Islamic Bank of Egypt, named after Prince Mohammad bin Faisal of Saudi Arabia who played an important role in their founding.

During the 1980s, Iran and Sudan initiated reforms in their respective countries resulting in the removal of all forms of interest from their national banking systems. Based on this Iran is widely regarded as the worlds biggest Islamic finance market with assets of $300 billion as of 2012.

South East Asian and Malaysian Growth

The initial failure of the Pakistani bank inspired Asian countries to attempt the establishment of an Islamic bank in a way that would be successful. In 1973, the Philippine government established the Philippine Amanah Bank which offers Islamic banking services alongside conventional banking.

Although Southeast Asia has been the birthplace of many practices, products, and services of the modern Islamic banking system, it did not play an important part in the development of Islamic banking practices until the establishment of the Islamic bank in Malaysia, which was founded in 1983.

Malaysia has since played a fundamental role in the modernization of Islamic banking practices and their incorporation into the mainstream global banking system. In this country, an Islamic financial institution already existed before the establishment of the first Islamic bank. The Muslim Pilgrims Savings Corporation, founded in 1963, helped pilgrims in Malaysia perform Hajj. This corporation was later renamed Tabung Hajj and helped pilgrims invest their Hajj savings into businesses in a way that adhered to Shariah. Tabung Hajj was so successful that it eventually led to the Bank Islam Malaysia.

In fact, Tabung Hajj was responsible for 12.5% of this bank’s initial capital. Islamic banks in Malaysia currently operate conventional and Islamic banking systems side to side, reflecting the global intentions of these banks. While Bahrain was initially at the forefront of Islamic banking on the global market, Bank Islam Malaysia quickly overtook them and currently is years ahead of Bahrain in regrards to innovation.

The first modern Sukuk was issued in Malaysia by Shell MDS in 1990, after which Malaysia has led the way in developing the Sukuk financial instrument – an interbank money market for Sukuk that was certified in 2003. With a deliberate intervention by the Malaysian government to stay at the forefront of innovation in the global Islamic market, banks in this country have a distinct advantage. It is not inaccurate to observe that Islamic banks have been largely responsible for much of Malaysia’s modernization and economic development in the last twenty years.

Pakistani Growth

In Pakistan, a new attempt to create an Islamic banking system took place in 1979, gradually eliminating interest from all banking operations by 1985. It is important to note that this forced conversion to Islamic banking is characteristic of banks in Pakistan and financial institutions in countries like Sudan and Iran, which is very different from more successful financial institutions like those in Malaysia. Although Pakistan was a pioneer in Islamic banking, the idea of Profit and Loss Sharing, which is fundamental to modern Islamic banking was not carried out, with most of the banks’ transactions being carried out in other ways.

Cross Border Islamic Finance Market

Islamic Development Bank

The Islamic Development Bank started operations in 1975, headquartered in Jeddah Saudi Arabia. Clause one of its charter states that it is “to foster economic development and social progress of member countries and Muslim communities individually as well as jointly in accordance with the principles of shariah.” In compliance, the IDB does not deal with interest. By the year 2000 the Islamic Development Bank had financed inter-Islamic trade to the tune of over 8 billion US dollars [7] and in 2014 was the single largest issuer of sukuk. It is the only body or country from Islamic lands, which is rated AAA.

Bahrain Islamic Bank

In 1979, the Bahrain Islamic Bank was established, with a major investment by Prince Mohammad bin Faisal. This bank was notable in that it collaborated heavily with other Islamic Banks in the region for investments and deposits, allowing the circulation of capital throughout Muslim countries. Although not participating in foreign exchanges, this bank also became part of Bahraini financial markets. Today, Bahrain is the leader in offshore Islamic banking due to having the highest number of offshore Islamic financial institutions.

International Islamic Financial Market (IIFM)

An important agreement was signed in 2001 between institutions in Bahrain, Indonesia, Sudan, Saudi Arabia, and Malaysia to create the International Islamic Financial Market (IIFM). The main goal of the IIFM is to support the creation of an international secondary market for trading of sukuk and other Islamic financial instruments. Since there are different interpretations of Shariah governing the different governments’ sukuk issuances, the IIFM serves the important role of conciling and harmonizing these financial instruments through its Shariah Supervisory Committee. This committee is composed of Islamic scholars from the different regions and Shariah schools from the member countries of the IIFM.

Thanks to the IIFM, sukuk quickly gained acceptance across national borders, a fundamental step in their popularization and establishment as legitimate, profitable financial instruments that would prove attractive to global investors. The IIFM also helped bolster cooperation among Muslim countries, strengthening economic ties and harmonizing different views of Shariah. One of the IIFM’s current top challenges is to address the increasing need for faster liquidity management that is a characteristic of modern markets and seen as the biggest weakness of Islamic financial instruments today.

Other organisations, which have been critical, are the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) a standard’s body based in Bahrain, and the International Islamic Liquidity Management (IILM) an issuer of short-term sukuk to assist with the liquidity of Islamic finance providers based in Kuala Lumpur.

A Natural Modern Era Evolution

There is clearly a natural evolution that has taken place in Islamic banking since the initial failure of the first Islamic bank in Pakistan. Throughout the 1970s, commercial banking operations using Islamic financing were the most common type of Islamic banking operation. In 1980, Islamic banks moved into syndication and project finance. The 1990s brought about the idea of equity and Ijarah (leasing,) which greatly diversified the potential avenues for Islamic banking. The 2000s were the most important decade in global Islamic banking. This is thanks to the emergence of sukuk and other structured Islamic financial assets which surfaced, along with the proliferation of a robust capital market. Since 2005, Islamic banking has innovated increasingly more sophisticated Islamic financial instruments capable of greater flexibility and agility in liquidity management.

Islamic financial services have quickly expanded outside of the GCC states and Malaysia and 2014 was a pivotal year, as it marked the issuance of sukuk by the United Kingdom, the first Sovereign sukuk issued by a non OIC country. The UK was very quickly followed by Luxembourg and South Africa.

The listing on the London Stock Exchange of the United Kingdom’s Sovereign Sukuk, the first issued by a non OIC member.

Perhaps there are other reasons why Islamic banking has proved so attractive to investors around the world. By operating in a way to does not conflict with Shariah, Islamic banking has carefully established the foundations for a promising new financial system. The Islamic banking system is unique in that it is entirely interest free, which has been around nearly since money itself. This interest free system, which avoids Riba, gambling, uncertainty, and ambiguity, could be the key to avoid the recurring burst bubbles, crashes, and schemes that have a characteristic of the conventional global banking system in the last decades. Islamic banking flies in the face of consumerism, of the idea that you can pay tomorrow for what you consume today.

Social Good

Conventional banking enslaves poor countries by crushing them under debt to rich countries. In the Muslim world, Interest does not exist, with financial transactions being based on real world value and development rather than in easily manipulated factors. It is essentially a banking system with a conscience, one of the most decried flaws of conventional banking by regular consumers.

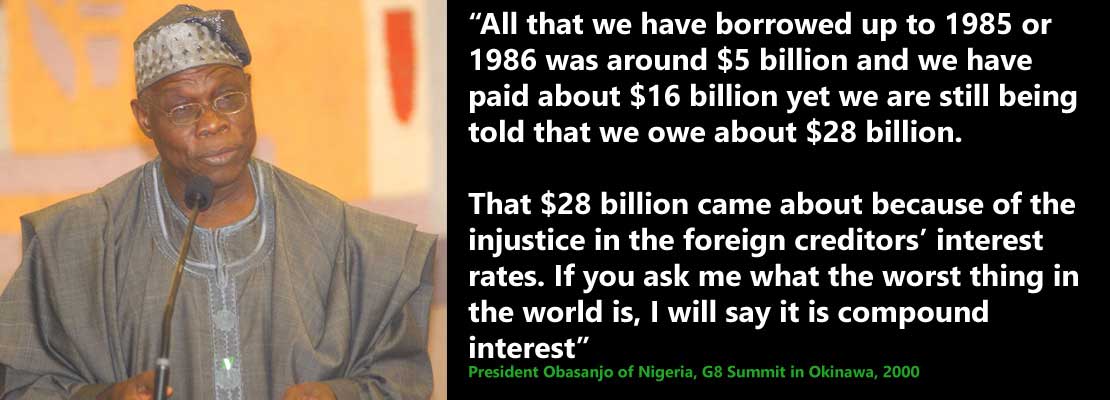

President Obasanjo of Nigeria, Statement as G8 Summit

The Islamic banking movement has been revolutionary in that it has quietly demonstrated that the established practices of conventional banking are not unmovable, that banking can have a moral compass.

[i] Economic Development and Islamic Finance, Zamir Iqbal and Abbas Mirakhor. World Bank Publication

[1] Shaikh M Ghazanfar – http://www.muslimheritage.com/article/capitalist-traditions-early-arab-islamic-civilization

[2] Islamic Finance: The New Regulatory Challenge – By Rifaat Ahmed Abdel Karim, Simon Archer APPENDIX/NOTES, point 3.

[3] http://www.hsbc.com/news-and-insight/2014/seeking-sukuk-success

[4] http://www.bankislam.com.my/en/Documents/cinfo/Sukuk_ShariahGuidelines.pdf – Amana Bank reference to Professor Murad Cizakca – 2009.

[5] FINANCIAL OUTLOOK OF THE OIC MEMBER COUNTRIES 2015 P27

[6] Genesis of Islamic Economics: A Chapter in the Politics of Muslim Identity by Timur Kuran, Page 303. – http://public.econ.duke.edu/~tk43/abstracts/articles/ar_32A.pdf / The

[7] http://www.siddiqi.com/mns/Lecture2.htm