Ijara Contract

Article Overview

An Ijara contract is a contract of exchange which is popular due to its similarity to a conventional lease. Ijara contracts are used in Islamic Banking, Project finance as well as in Sukuk.

In an Ijara contract one party purchases and leases out the equipment required by the client for a rental fee. The duration of the rental and the fee are agreed in advance and ownership of the asset remains with the lessor.

An example of an Ijara contract is an Islamic Bank purchasing a house for a customer, and adding management costs. The customer then pays a rental fee until the total cost has been paid off, at which point the ownership of the asset is transferred to the customer.

In the context of Sukuk, Ijara are securities representing the ownership of assets that are tied up to a lease contract. This means that Sukuk using the Ijara contract can be traded in the market at a price determined by market forces.

Characteristics of Ijara as used in Sukuk

- Ijara are subject to risks related to the ability and desirability of the lessee to pay the rental instalments. Moreover, these are also subject to real market risks arising from potential changes in asset pricing and in maintenance and insurance costs.

- The expected net return on some forms of Ijara may not be completely fixed and determined in advance, since there might be some maintenance and insurance expenses that are not perfectly determined in advance.

- Ijara are completely negotiable and can be traded in the secondary markets.

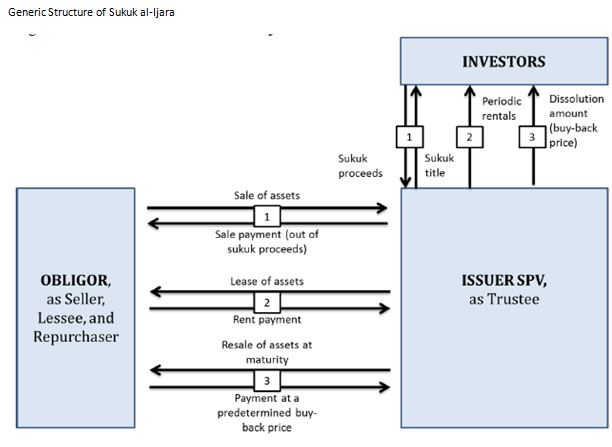

In an Ijara contract as used for a Sukuk, an issuer often in the form of a Special Purpose Vehicle (SPV) or a Trust issues sukuk to finance a purchase of one or more assets from the obligor (the financed party). The assets will then be leased out to a lessee, whose lease payments will form the periodic payments to the investors (sukuk holders). At maturity, the assets will be repurchased by an obligor at a predetermined price; the proceeds of this sale will be transferred to the sukuk holders.

Taxation Issues

Being a contract of exchange where the ownership of an underlying asset is transferred between owners, it is only used in jurisdictions which provide tax neutrality.

In a Ijara structure, tax issues in non tax neutral jurisdictions cause challenges around capital gains, sales tax and stamp duty as a transfer of asset to a SPV occurs at the start of the transaction and then once more on a purchase undertaking at maturity.

Criticisms of Ijara

There have been concerns with regards to true transfer of ownership in an Ijara contract, specifically the moving of assets off the issuers balance sheet, as opposed to transferring only beneficial ownership of the underlying assets. In 2014, the Dubai Financial Market ruled that it required that the sale “genuinely [transfer] to the sukuk holders […] all privileges of ownership to conduct all legally valid acts [including] all acts of disposal, including transferring its title from its seller to the sukuk holders from both legal and Shari’a perspectives”.

Limits of Ijara

Ijara structures have a limit, as typically the most expensive asset which can be transferred is real estate, and that has a financial value limit both from a sale and rental income perspective, especially for corporate issuers for whom typically their most valued real estate asset will be their headquarters.

Further Reading

For a more detailed overview of this structure as used in Sukuk, please download Sukuk Guide of Dubai International Financial Centre (3.7MB) or Shariah Resolutions 2nd Edition (2.3MB). Most computers will open PDF documents automatically, but you may need Adobe Reader.

Sources

Accounting and Auditing Organisation for Islamic Financial Institutions (2010), “Sharia Standards for Islamic Financial Institutions”, Bahrain.

World Bank – Sukuk markets: A proposed approach for development.