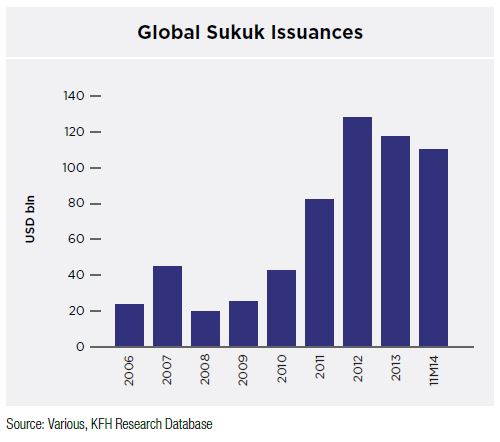

Sukuk issuances rose to USD114.7bln in 11M14 (Jan-Nov 2014), a sizeable 8.6% increase from the USD105.6bln volume recorded during 11M13. Sovereign issuances accounted for almost 80% of total issuances.

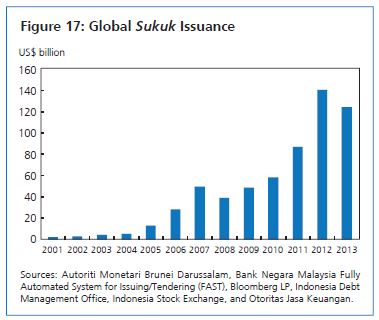

The Sukuk record for issuances was in 2012 when $137.1 billion was raised, while issuance dropped to $116.9 billion in 2013 and fell further in 2014.

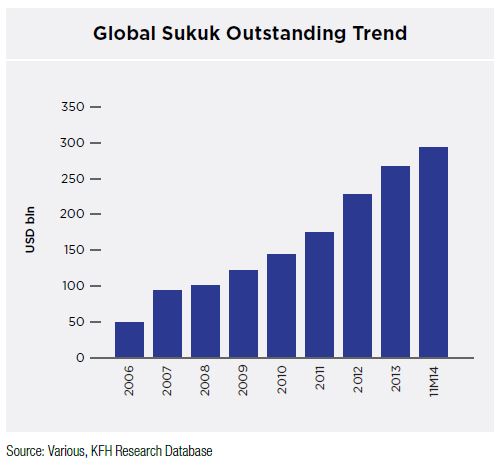

Global sukuk outstanding increased to a record of USD300bln as of 11M14, an 11.4% rise from USD269.4bln at end-2013. By domicile, Malaysia’s secondary sukuk market is was valued at USD173.4bln, a 9.6% increase year-on-year (y-o-y). Meanwhile, the total GCC sukuk outstanding portfolio grew by 6.4% to USD90.8bln, as compared to USD85.3bln outstanding at end-2013.

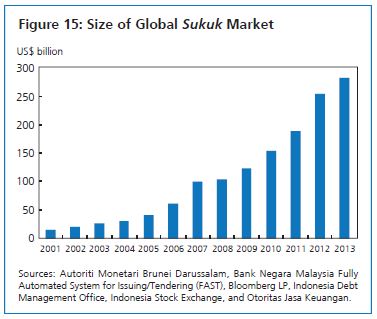

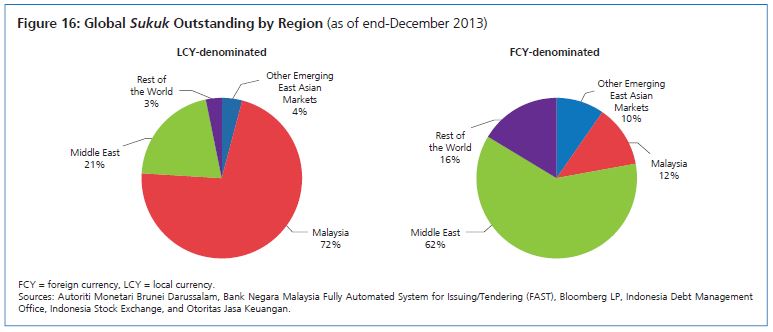

Since 2001, the global sukuk market has grown by leaps and bounds, posting compounded annual growth rates of 27.8%. From just US$14.8 billion in 2001, the amount of sukuk outstanding globally reached US$281.3 billion at end-2013 (Figure 15). Malaysia remained the largest sukuk market, accounting for 58.1% of total outstanding sukuk. Middle Eastern countries account for 30% of the total, while other emerging East Asian markets (excluding Malaysia) only account for 6%. Malaysia continues to dominate the local currency (LCY)-denominated sukuk market, while the Middle Eastern markets are the most active issuers of foreign currency (FCY)-denominated sukuk (Figure 16). [2]

At end-2013, the size of the LCY-denominated sukuk market reached US$216.2 billion, while FCY-denominated sukuk stood at US$65.1 billion. Sukuk may be issued by sovereign and quasi-sovereign institutions, and corporate entities. In 2013, global sukuk issuance once again surpassed the US$100 billion mark, reaching US$123.7 billion (Figure 17). Malaysia was the most active sukuk market with issuance amounting to US$83.7 billion, accounting for 67.7% of global sukuk issuance for the year. Sukuk issuance in Middle Eastern markets represented 20.6% of the total, while issuance in other markets in emerging East Asia (excluding Malaysia) comprised a share of 6.0%. After Malaysia, the most active sukuk market in emerging East Asia in 2013 was in Indonesia, with sukuk issuance of US$5.4 billion. The Indonesian government successfully issued US$1.5 billion of global sukuk in September, its largest global sukuk issue to date at a time when most sovereigns were hesitant to borrow overseas.

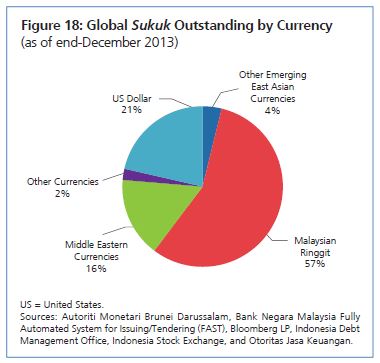

At end-2013, MYR-denominated sukuk accounted for nearly 60% of total sukuk outstanding, US$-denominated sukuk accounted for 21% of the total, and sukuk denominated in Middle Eastern currencies had a share of 16% (Figure 18). Sukuk denominated in other emerging East Asian currencies (excluding Malaysia) only represented 4% of the total.

Malaysia is seeking to develop itself as an offshore sukuk center for other countries. There have been issuances of MYR-denominated sukuk from foreign issuers in the past, including National Bank of Abu Dhabi, Gulf Investment Corp., and Noble Group. Currently, Malaysia is developing itself as a multi-currency sukuk center. For example, two Malaysian entities issued the first CNHdenominated sukuk. Danga Capital’s issuance of 3-year CNH-denominated bonds in 2011 was followed by Axiata’s 2-year CNH-denominated bonds in 2012. The CNH sukuk are also designed to take advantage of regional demand for the reminbi.

Malaysia and Hong Kong, China have partnered together to develop the Malaysian market as an offshore renminbi and Islamic finance center. In December 2013, a Joint Forum on Islamic Finance and a Dialogue on Offshore Renminbi Business was held. The two economies are seeking to leverage their respective strengths in the development of the renminbi sukuk market: Hong Kong, China in offshore renminbi and Malaysia in sukuk.

Sources

Asia Bond Monitor Asian Development Bank

Malaysia International Financial Centre (MIFC)

[1] In this special section, emerging East Asia refers to Brunei Darussalam; the People’s Republic of China (PRC); Hong Kong, China; Indonesia; the Republic of Korea; Malaysia; the Philippines; Singapore; Thailand; and Viet Nam.

[2] LCY-denominated sukuk are defined as sukuk denominated in the issuer’s home currency (e.g., a Malaysian company issuing MYR-denominated sukuk). FCY-denominated sukuk are defined as sukuk denominated in a currency other than the issuer’s home currency (e.g., a Middle Eastern company issuing US$-denominated sukuk).