Integration between the world halal industry and the global Islamic finance system is a huge developmental potential for the growth and expansion of Islamic economics in the world markets. Increasing demand for halal products from growing Muslim communities provides opportunities for Islamic finance to ensure a complete cycle of Shariah-compliant products and services. »

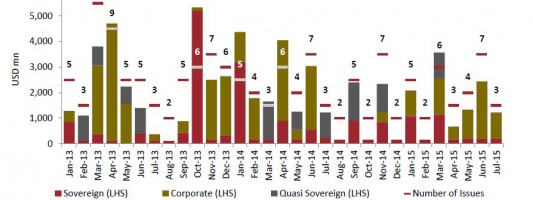

The report concludes "The Sukuk market should continue to perform well as supply has waned this year, although there is expectation that some GCC countries may want to finance their budget deficits by borrowing in the debt capital markets which would lead to some welcome supply in the market." »

In just four decades, the Sharia compliant finance industry has grown from a niche banking system to be regarded as one of the fastest growing segments of the global financial industry, with total global financial assets estimated to be around USD2tln. The past five years have been most significant, recording 17.3% Compounded Annual Growth Rate spurred by improved industry infrastructure, a more c... »

UK Trade & Investment today released a brochure which contains Sharia compliant UK regeneration investment opportunities in the UK. »

Saudi Arabia makes Bond Sales to Fund Deficit, Saudi Arabia makes Bond Sales to Fund Deficit and Islamic Bank Finances Surge 107% in Oman. »

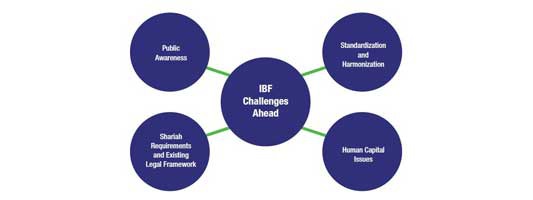

The financial sector plays a critical role in the socio-economic development of any country. Of importance, Islamic economics was designed as a just and ethical financial system, supporting the efficient allocation of resources both for wealth creation purposes, as well as the betterment of society. Finance based on Islamic principles is expected to further enhance socio-economic well-being in co... »

Financial Inclusion is a hot topic in developing countries. To maintain growth the industry needs to reach and acquire large swathes of unbanked populations. Account penetration rates in key regions such as the Middle East, Sub- Saharan Africa and South Asia remain fairly low. In the Sub-Saharan African region, amongst the 34% of adults with an account, almost a third of account holders – or 12% ... »

Report presents the output of two-year collaboration between the Centre for Islamic Economics, IIUM and the Statistical, Economic, Social Research and Training Centre for Islamic Countries (SESRIC) on a research project that covered three OIC member countries namely, Malaysia, Indonesia and Bangladesh. »

An IMF working paper examined key features of modern public debt management legal frameworks and took a specific look at Sukuk legal frameworks in the UK, Turkey and Luxembourg. »

Sukuk structures in accordance with the principles of Shari’ah are the same as the principles which apply to other products in Islamic law and finance. Real world case studies and guides produced by Latham and Watkins, and Linklaters. »