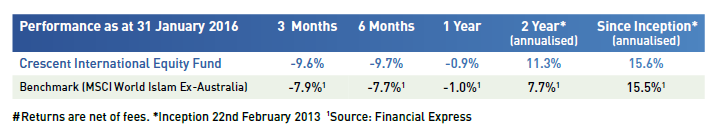

Crescent International Equity Fund Performance as of 31 January 2016

Article Overview

Issuer: Crescent Funds Management (Aust) Limited ACN 144 560 172; AFSL 365260

Market Commentary

It was a volatile and difficult start to 2016 for equity markets which fell sharply in the first three weeks of January on the back of renewed concerns over the growth outlook in China and the global economy, and further declines in the oil price.

The markets began to stabilize however, on hopes that the major central banks would loosen monetary policy further in response to the downside risks to growth and inflation. To this end, the Bank of Japan surprised investors when it announced a negative deposit interest rate of -0.1% at its end of January meeting. Likewise, the ECB suggested that all policy options will be considered at its March meeting, including further reductions in the deposit rate.

Finally, there is speculation that the Fed rate hikes might be more subdued than initially expected, with more economists now speaking about a “one and done” scenario.

Top three gainers for the fund in January 2016 were Telekom Indonesia (+13.63%), Under Armour (+9.12%) and MTN Group (+7.83%). Meanwhile top three decliners included Murata Manufacturing (-20.02%), McKesson Corp. (-15.96%), and Shire plc (-15.47%).