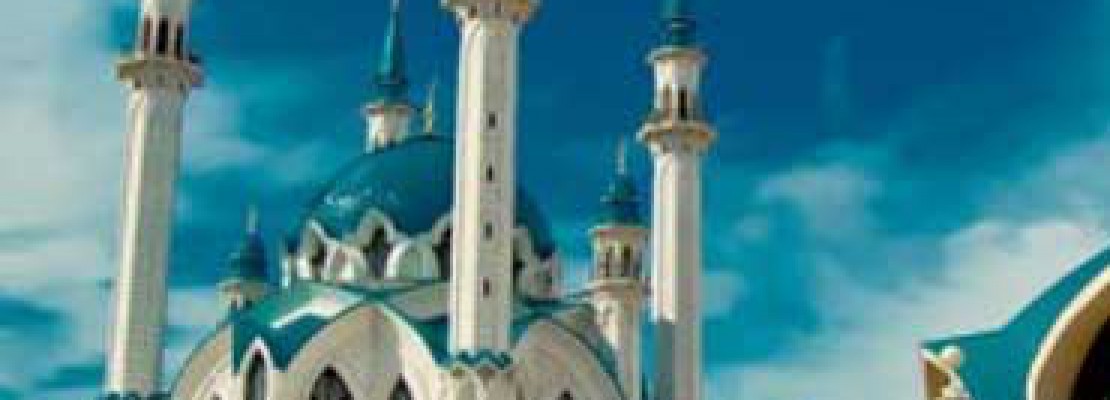

Second Wave of Islamic Finance

Article Overview

In an article for the Russian International Affairs Council, Yuri Barmin Analyst on Russia and its Middle East policy presents a great overview of the current state of affairs of the development of Islamic finance within Russia and the CIS. Yuri discusses the double push by Russian banks to enter into the Islamic financial market, initially during the global financial crisis in 2008 and most recently since 2014 due to the imposition of EU sanctions.

The initial push by VTB to issue a $200 million sukuk in 2009 in cooperation with Kuwait Finance House fell through due to a complexities, though Ak Bars from Tatarstan was later successful in tapping Middle Eastern investors in 2011 and 2014. An “Islamic window” was launched in the Bashkir branch of the Nizhniy Novgorod-based Ellipse Bank.

Referring to a Russian language article the author states that Islamic banking could account for up to 5% of the entire financial market in Russia just five years after its legalization. As of now, several Islamic banks have voiced their intention to open branches in Russia. They include Bahrain’s Al Baraka, Sudan’s Al Shamal, UAE’s Al Hilal as well as leading Malaysian banks.

Legal Framework Lacking

Referring to a lack of legal framework, “The development of Islamic finance in Russia is hampered by the absence of a necessary legal framework. For instance, Russian laws do not contain definitions of such terms as “an Islamic financial institution” or “a bank acting in compliance with the principles of Sharia law”, as well as a number of other terms specific to this type of banking.”

Geo Political Concerns

A not often discussed topic is raised, that of a potential Russian wariness of the links of Saudi Arabia to Islamic finance. The author states “Russia has been trying to limit Saudi influence in the Muslim regions of the North Caucasus and the Volga Federal District since the early 2000s. Some Russian security officials confirmed to this author that they believe the exposure of the Russian banking industry to Islamic finance would lead to an upsurge in covert Saudi influence in the country.

This fear is also underpinned by the role that the Jeddah-based Islamic Development Bank (IDB) plays in the expansion of this industry. IDB is actively involved in the negotiations with the Russian Central Bank to introduce Islamic banking in the country and supports a proposal to transform Tatarstan into a regional hub of Islamic finance.”

Read full article: Alternative Finance in a Time of Crisis: How Russia is Looking to Introduce Islamic Banking