Commentary by RHB Global Sukuk Markets Research, Kuala Lumpur, Malaysia

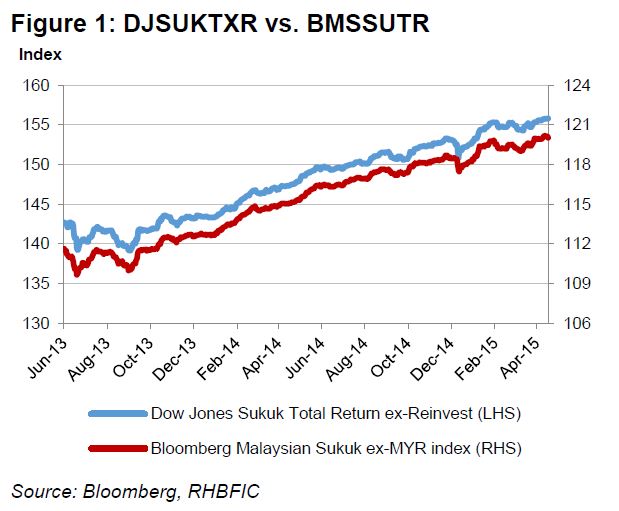

The Bloomberg Sukuk Market Return Index (BMSSUTR) fell by 0.09% W-o-W (vs. +0.17% in week prior) to 120.06, bringing YTD returns to 1.58% (vs. 1.67% in week prior).

The Dow Jones Sukuk Total Return Index (DJSUKTXR) flattened, up 0.02% W-o-W (vs. +0.08% in week prior) to 155.78, bringing YTD returns to 2.15% (vs. 2.05% in week prior). Despite the rise in US jobless claims to 295k, market perceived job market remain healthily below the 300k mark. Stronger 1Q15 company results in the gulf, oil prices rebound and regional tensions limit the rally seen earlier. The bottom 5 movers in the BMSSUTR during the week were PETMK 20, QATAR 23, MALAYS 21, GBHK 19 and SECO 24 shedding market value by USD2.4bn.

Risk premiums generally eased in the GCC (ex-Dubai) despite Bahrain and Turkey touching one-year highs during the week. Bahrain 5y CDS ended 7.7bps lower at 305bps despite reaching a 52-week high of 320bps last Friday after Moody’s downgraded its sovereign ratings to Baa2/Neg. Similarly, CDS for Turkey touched one-year highs of 233bps before closing 1.9bps lower at 229bps after the country’s central bank kept interest rates at 7.5%; while other GCC members were stable despite airstrikes in Yemen during the week with CDS closing 1bp-5bps lower for Saudi Arabia (to 71bps), Abu Dhabi (61bps), and Qatar (63bps) while Dubai rose 1bp to 198bps. Elsewhere, risk premiums rose around 3bps in Indonesia and Malaysia to 160bps and 125bps respectively.

UAE banking sector show resilience in 1Q15 financial results, with most banks showing growth in assets and profits, in addition to improving asset quality indicators. Abu Dhabi based First Gulf Bank (FGB) and Abu Dhabi Commercial Bank (ADCB) both reported a rise in net income increase of 7% and 13% respectively, and both reporting improving results on non-interest income by 13% and 19% respectively. Gulf banks indicate resilience despite the oil rout and geopolitical heat in the region, and we think that increased demand for financing ahead of large scale projects should support lending growth in the region. Nevertheless, we still think sovereigns will continue to dominate USD-denominated sukuk issuance this year in preparation for infrastructure needs leading up to international events in the medium term. Despite reserves declining (e.g. Saudi Arabia: -4.4% since June 2014 to USD714bn) reserves are still large enough to support fiscal pressures in the region, for now