The Islamic Investor: Profit from Nigeria’s World Class Sharia Listed Companies

Article Overview

Nigeria is Africa’s biggest economy and second only to Saudi Arabia in terms of Organisation of Islamic Cooperation (OIC) members GDP ranking. It currently presents an interesting investment case for the Islamic investor.

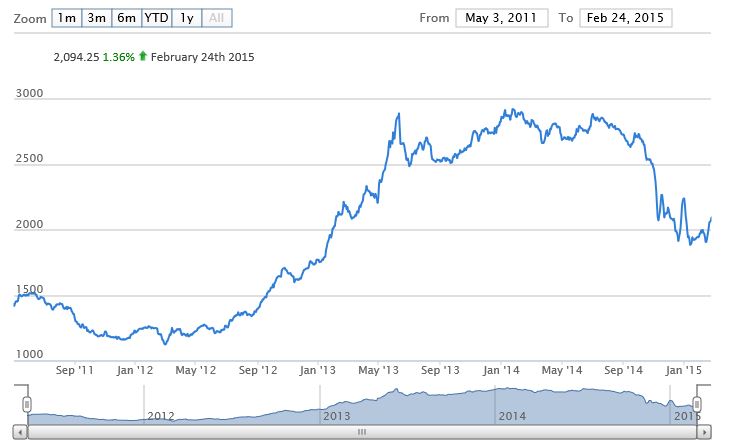

Nigeria is experiencing challenging times through a combination of economic and political headwinds. The collapsing price of its main export – oil, a devalued currency – the Naira being a victim of the surging US dollar, delayed general elections and civil strife in the north of the country represent a combination of problems, which has resulted in the Nigerian Stock Exchange Lotus Islamic Index experiencing a 35% drop from its peak set last year.

The Nigerian Stock Exchange Lotus Islamic Index has dropped 35% from its peak, a drop which has been coupled with a 25% drop in the value of the local currency Naira against the US dollar.

However none the problems Nigeria faces are new, it has dealt with such challenges before and with the recent stabilisation of the oil price as well as easing off on US dollar strength, combined with favourable demographics, the contrarian Islamic investor is able select rich picking from Nigeria’s certified Sharia companies for long-term dividend returns and growth.

A Closer Look at the Sharia Gems

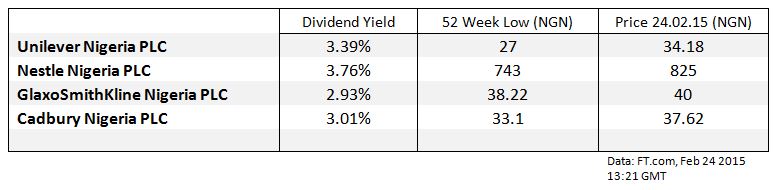

Components of the Nigerian Stock Exchange Lotus Islamic Index represent 15 of the leading Sharia certified stocks in the country including Nigerian centric world class blue-chip companies such as Unilever, Nestle, GlaxoSmithKline and Cadbury who not only serve Nigeria’s 170 million population, but the wider West African region.

Fundamentals for these companies have not drastically changed but recent price drops represent an opportunity for the value seeking Islamic investor to lock in good yield and benefit from price increases when confidence returns. Furthermore, the devalued Naira presents an additional opportunity for currencies in the Gulf and Asia which track the dollar, holders of such currencies have seen their Nigerian purchasing power increase by 25% just by holding a stronger currency.

Stock investments are a balance of risk and reward seen with nascent potential. On the reward side Unilever, Nestle, GlaxoSmithKline and Cadbury tick the boxes with regard to solid corporate governance, leading product offerings, strong dividend yield, price growth potential, which coupled with a smooth national election as well as recovery in the oil price and in the Naira present long-term return potential based on these stocks being undervalued. From a risk perspective it’s likely to be a turbulent ride which over the long-term should be sufficient to unlock and profit from the potential of these undervalued Sharia certified stocks.

Selection of Components of Nigerian Stock Exchange Lotus Islamic Index

Some UK investment funds are beginning to tactically invest in Nigeria, and Thomas Becket, chief investment officer at Psigma Investment Management, recently said, “I wouldn’t be too bearish about Nigeria on a long-term perspective, it’s one of the more liquid frontier markets”. Emily Fletcher co-manager of Blackrock Frontiers Investment Trust stated “Longer-term stocks in Nigeria are trading on very cheap valuations”.

Islamic Finance in Nigeria

Financial inclusion is a common theme in Africa and according to a Gallup poll conducted in 2011, 22.8% of Muslim Djiboutians who do not have a bank account have cited religious reasons. As Islamic financial services become available to such people, the size of the sector is set to increase causing a ripple effect into Islamic investment products.

Lotus Capital is the leading Islamic Asset Manager in Nigeria having launched in 2004. Its CEO, Hajara Adeola stated growth within the sector will come from large swaths of population who remain outside of the conventional financial system, who when they begin using Sharia compatible products will lead to increased volume and market size of the Islamic finance sector.

Nigeria is the financial and economic centre of West Africa with a population of 173 million and a GDP of $521.8 billion in 2013. It has an emerging Islamic finance sector, with a State level Sukuk issued by the Osun State in late 2013, as well as the fully fledged Islamic Jaiz Bank launched in 2003.

Disclaimer: This content has been prepared solely for informational purposes, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security, product, service or investment. The opinions expressed do not constitute investment advice and independent advice should be sought where appropriate.