Murabaha Contract

Article Overview

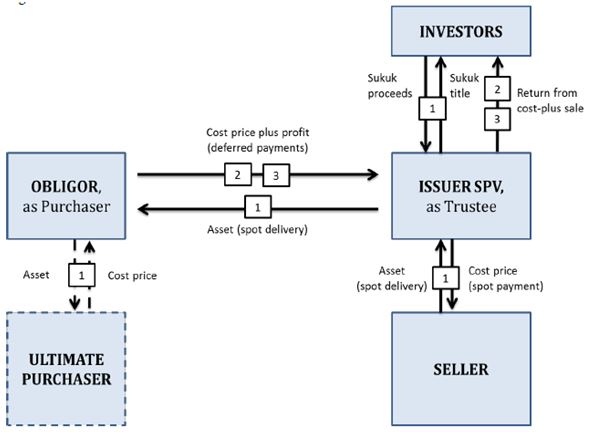

Murabaha is a contract of exchange based on sale-and-purchase contracts with a predetermined cost and profit. The seller states the cost he has incurred on the asset to be sold and sells it to another person by adding some profit or mark-up to the buyer.

The bank must take constructive or actual possession of the goods before selling it to the customer. It is a very popular form of financing used by Islamic Banks to finance for example Car purchases, as well in Sukuk, where it is seen as a structure which is relatively close to conventional bonds, and along with Ijara it is the most common contract structure used.

Criticisms of Murabaha Contracts

Murabaha contracts are not without controversy with some Islamic scholars argue that murabaha contracts don’t share risk and thus are not Sharia compliant — and experts estimate that such contracts constitute up to 80 percent of the global Islamic finance volume.

Characteristics of Murabaha as used in Sukuk

- Murabaha is typically short-term debt popular in Malaysia.

- Murabaha sukuk are only feasible in the primary market and are held till maturity. The trading of these contracts on the secondary market is not permitted, as the certificates represent a debt owing from the subsequent buyer of the Commodity to the certificate-holders and such trading amounts to trading in debt on a deferred basis, which will result in riba.

- Salam and Mudaraba are not tradable (except in Malaysia) and only used in primary market for buy and hold till maturity.

Further Reading

For a more detailed overview of this structure as used in Sukuk, please download Sukuk Guide of Dubai International Financial Centre (3.7MB) or Shariah Resolutions 2nd Edition (2.3MB). Most computers will open PDF documents automatically, but you may need Adobe Reader.

Sources

Accounting and Auditing Organisation for Islamic Financial Institutions (2010), “Sharia Standards for Islamic Financial Institutions”, Bahrain.

World Bank – Sukuk markets: A proposed approach for development.